The Global Energy Architecture Performance Index Report 2016, launched today, ranks 126 countries on their ability to deliver secure, affordable and sustainable energy

The Global Energy Architecture Performance Index Report 2016, launched today, ranks 126 countries on their ability to deliver secure, affordable and sustainable energy

· Findings reveal that all countries can improve rankings and that major economies – with the exception of France – struggle to take the lead, as transitions take longer to unfold owing to the size and complexity of their energy systems

· Three key trends are shaping the energy transition: Infrastructure and resilience; digital disruption and a new global energy security order

· Accelerating changes in technology, energy markets and geopolitics are creating new opportunities and also threats to energy security

Geneva, Switzerland, 2 March 2016 – Today the World Economic Forum released the fourth edition of the Global Energy Architecture Performance Index Report. The 2016 report puts the spotlight on energy security and access. Evolution in this area is being shaped by the fast transition underway in the energy sector, with several elements playing important roles, such as the fast growth of distributed renewable energy and recent developments in digital technology and international security.

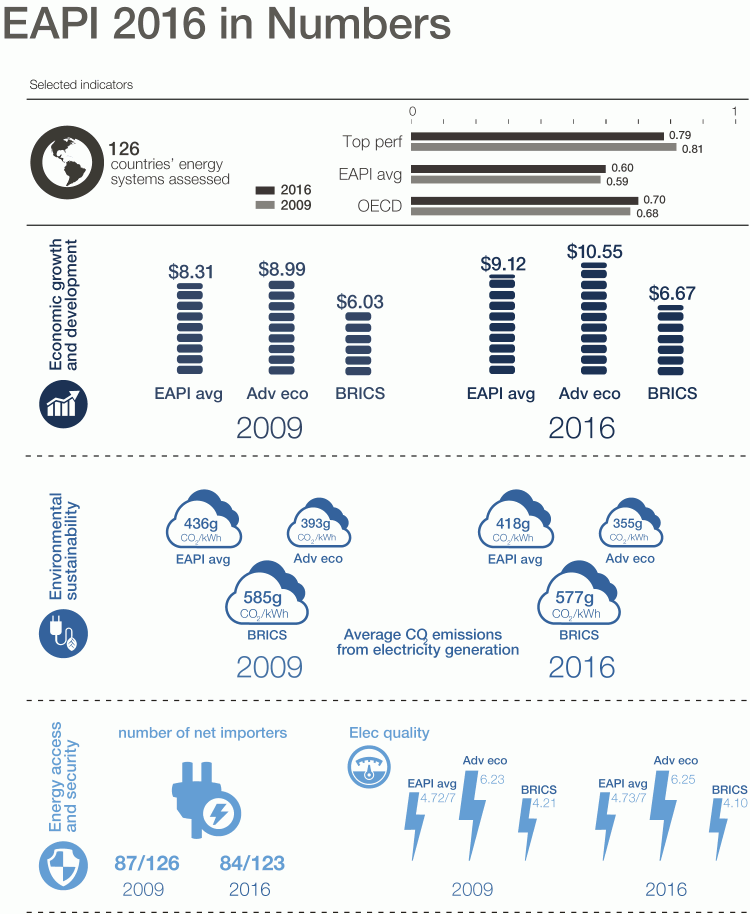

The annual index provides a benchmark to help countries address energy transformation challenges and identify opportunities across their energy systems. This year’s study explores the energy architecture of 126 countries based on their ability to provide energy access across three dimensions of the “energy triangle” – affordability, environmental sustainability, security and access.

The shortlist of top performers is again led by Switzerland (1st) and Norway(2nd), both demonstrating a well-balanced energy system within the “energy triangle”. Several countries are moving up in the ranking compared to a 2009 benchmark established to enable trend analysis over a seven-year period, withColombia (8th) and Uruguay (10th) the only non-OECD countries now in the top 10. Following successful energy reforms, both are showing particular strength in terms of the energy sector’s contribution to economic growth and development. Uruguay has also increased significantly the share of renewable energy in the mix. Other countries showing strong improvement in ranking compared to the 2009 benchmark include Azerbaijan, Chile and Indonesia. Despite having moved from being a net energy exporter to a net importer, Indonesia has improved its overall performance in recent years, notably through a strong increase in GDP created per unit of energy used and a reduction in price distortion related to government subsidies.

Major global economies continue to perform less well on the index as their transitions take longer to unfold due to the complexity of their energy systems. With the exception of France (4th), none of the 12 largest countries by GDP made it into the top 10. Following the nuclear accident in Fukushima, Germany(24th) decided to phase out nuclear energy production by 2022, and aims to reduce emissions by 80% by 2050. While the country has built impressive renewables capabilities, its energy transition has seen sharp increases in electricity prices. The United States is 48th overall – thanks to the growth of unconventional oil and gas production, it ranks high in energy access and security and has improved on environmental sustainability with gas replacing coal for power production. Japan’s performance (50th) has dropped compared to the 2009 benchmark as it continues to be affected after the Fukushima nuclear accident by the implications of high-costs energy imports, higher energy import dependence and increased CO2 emissions.

Prepared in collaboration with Accenture, the report finds that large emerging economies are pressed both by the need to support economic growth and build resilient and sustainable energy architecture. Brazil (25th), the top performing BRIC nation, benefits from a diversified energy mix with a considerable share of low-carbon energy, and a growing domestic oil and gas sector providing revenues and reducing the need for energy imports. The Russian Federationranks 52nd, with its main area of strength being energy access and security with challenges in terms of fuel price distortion. South Africa (76th) has improved its energy system performance compared to the 2009 benchmark across all three core dimensions following energy reforms that have notably improved energy access and expanded renewable energy. India’s (90th) challenges include the need to increase energy delivery to meet its growth targets and expand access to energy. Nevertheless, electrification has progressed and is now accessible to 79% of the population. China (94th) has embarked on significant energy reforms to reduce energy intensity of growth and improve sustainability – the results of which will no doubt positively impact its overall energy system performance in coming years.

“Over the past year, global conditions have continued to be challenging for the energy sector,” explains Roberto Bocca, Head of Energy Industries and Member of the Executive Committee, World Economic Forum. “Changes in energy prices and production, a slowdown in the growth of emerging economies and geopolitical instability have effectively reshuffled energy demand and supply scenarios. In this context, effective collaboration between stakeholders in the energy sector and beyond will be critical for developing a sustainable approach to meet the world’s future energy needs.”

“Major driving forces are prompting fundamental transformations across global energy systems,” said Arthur Hanna, Senior Managing Director, Energy, Accenture Strategy, Accenture. “Successful transitions will rely on the ability of companies to ensure affordable and secure supplies, and to reap the benefits of new technologies. Governments will need to play a critical role by monitoring opportunities resulting from developments in the energy sector, and by taking new approaches to governance to safeguard energy security.”

Energy access and security concept

With digital enablers and renewable energy, the energy sector has seen more changes in the last decade than in the previous century. Historically, discussions about energy security have centred on securing supplies of hydrocarbons and transporting them to market. While these concerns are still relevant, new ones are becoming strongly relevant and driving unprecedented change across the energy security landscape.

Three key trends re-shaping this landscape have potentially far-reaching implications for countries and companies, creating opportunities but also bringing new challenges:

1. Infrastructure and resilience: the transition towards more renewable energy and diversified supplies is creating opportunities and challenges for energy security. The rapid growth of renewable energies is supporting the diversification of the energy mix and enhancing security. The installed capacity of distributed generation from intermittent sources is expected to more than double in the next decade. Such growth presents long-term potential for improved performance across the value chain. However, diversification of energy generation requires changes to the electric utility business model, to grid management and to regulatory policies to ensure reliable supply. Continued investment in traditional fuels and centralized grid infrastructure is still very much needed for energy access and security.

2. Digital disruption: The growth of intelligent power grids and interconnected assets offers benefits as data can be used to optimize energy production and consumption. But it also risks disruption having stronger ripple effects on energy markets and prices. The convergence of physical and digital infrastructure – notably in electricity – is driving a stronger focus on the cybersecurity of grid systems. Global inexperience in handling large-scale cyberattacks, combined with the greater capabilities of state and non-state actors, has increased the likelihood that future wars and attacks will have a larger cyber component, which increases the need to better protect critical energy infrastructure.

3. A new global energy security order: the rebalancing of energy supply and demand is leading to a rebalancing of power and a new global energy security order. The recent drop in oil prices has led to a significant shift in wealth from net oil exporters to oil importers. At the same time, the development of unconventional sources of oil and gas and the recent economic slowdowns in emerging markets, such as China and India, have contributed to price readjustments amid a general shift in energy supply patterns. Geopolitical shifts, the new distribution of power and energy trade flows will create challenges and opportunities for energy security in the new energy architecture.