Amsterdam, the Netherlands: The world’s leading pharmaceutical companies are doing more to improve access to medicine in developing countries, with a raft of new initiatives, scale-ups and innovations over the last two years. However, the industry struggles to perform well in some practices that matter, according to the 2014 Access to Medicine Index, published Monday.

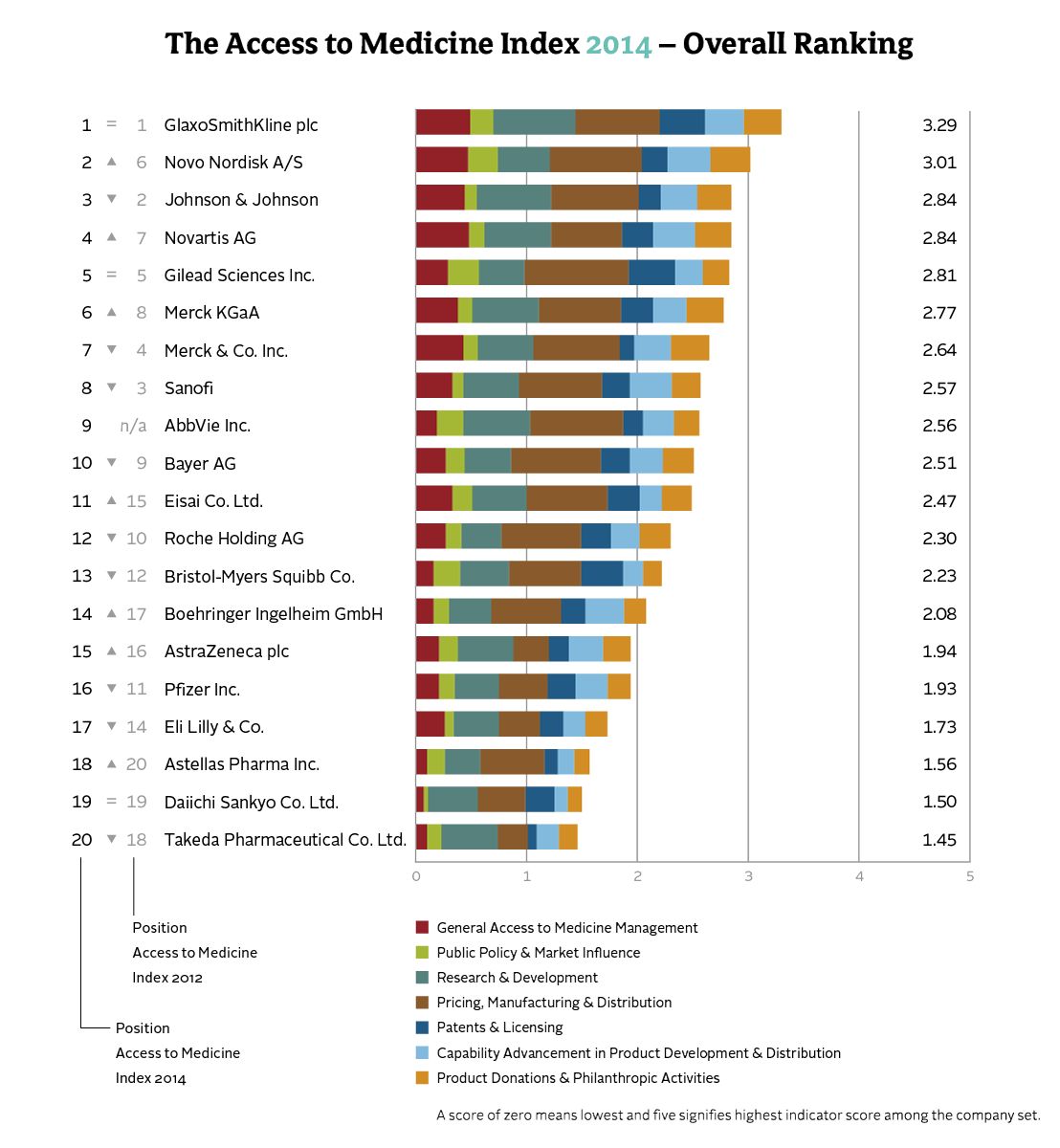

GSK tops the Index for the fourth time. This is driven by robust performance across most areas, with several innovative practices. Novo Nordisk has made the most progress, improving in five of the seven areas the Index focuses on. This has resulted in a remarkable leap from 6th to 2nd place. Sanofi and Pfizer fell down the ranking most significantly.

“After sharpening what and how we measure, we are now able to draw a much clearer picture of the industry’s strengths, weaknesses, progress and struggles, and what it takes to be a leader in access to medicine,” said Wim Leereveld, founder and CEO of the Access to Medicine Index. “No company is in the top five in all areas we analyse, but the leaders tend to perform well across most of them, even though they differ in their focus. Top performers innovate constantly, and usually have to innovate in several areas to maintain their position.”

The Access to Medicine Index is an independent initiative that ranks the world’s leading pharmaceutical companies according to what they are doing for the millions of people in developing countries who do not have reliable access to medicine. It scores companies across seven areas of activity considered key to improving access to medicine, including product research and development, to what extent they facilitate or resist efforts to create generic versions of their drugs, how they approach pricing in developing countries, lobbying activities and marketing ethics.

“Companies that have the biggest market presence are not necessarily at the top of the Index. We found that four companies currently produce 50 percent of all the relevant products. However, they are scattered across the Index,” said Jayasree K. Iyer, Head of Research at the Access to Medicine Index. “This means that what defines where companies rank has less to do with how many relevant products they have, than with what they do with their products and expertise.”

Progress on several fronts

The industry has stepped up its efforts on several fronts. For instance, it is paying more attention to socioeconomic factors, increasingly tailoring prices within countries. Since 2012, the number of products in the pipeline appropriate for developing countries has grown by 47. More companies are experimenting with innovative access-oriented business models. Companies are granting more licences to developing country companies to make and distribute generic versions of their medicines. Meanwhile, policies and activities to improve access to medicine continue to get better organised.

Performance weak in two areas

However, progress is uneven across the areas of activity that matter, with the industry struggling to perform well in two important areas.

Firstly, nearly all companies (18) have been the subject of settlements or judgements regarding breaches in ethical marketing, bribery or corruption standards or competition laws in the last two years. During the period of analysis there were high-profile allegations of corrupt practices against several companies operating in China. The case against GSK, one of those companies, was settled after the period of analysis, and therefore did not affect its score in the 2014 Index.

Secondly, companies remain conservative in their disclosure of where patents are active and when they will expire – information that is very useful to medicine procurers and generics manufacturers.

Research and development analysis

Pharmaceutical company research and development (R&D) is a crucial element of enhancing access to medicine. The 2014 Index reveals how concentrated the relevant R&D is. Just five companies are developing 54% of the 327 products in the pipeline. All disease classes are being targeted, but more than half of the products under development target just five diseases: lower respiratory infections, diabetes, hepatitis, HIV/AIDS and malaria.

About 36% of the pipeline targets non-communicable diseases, which are becoming increasingly important in developing countries. But plans to make these products available in developing countries are limited. Pricing strategies for them are also limited, and lag behind those for many communicable diseases.

More than half of the companies are developing “child-size” medicines, as liquids, chewable tablets, child-appropriate doses, or new formulations.

Since the 2012 Index, at least 30 products from the pipeline, for 11 diseases relevant to developing countries, have come to the market. These include:

- A new type of pill for multi-drug resistant tuberculosis that is the first new drug for the disease in 40 years. (Johnson & Johnson)

- A ground-breaking pill that can cure hepatitis C, which is a high-burden disease in developing countries. The company has issued licences allowing distribution of generic versions of the drug in more than 91 developing countries. (Gilead)

“Our company report cards identify a tailored path for each company to follow in order to maximise its opportunities for improving access to medicine. They all address access issues in different ways, but our analysis shows that all companies can do more,” Leereveld said.

About the Index: The Access to Medicine Index is published by the Access to Medicine Foundation, a non-profit organisation based in the Netherlands that aims to advance access to medicine by encouraging the pharmaceutical industry to play a greater role in improving access to medicine in less developed countries. The Index methodology was developed, and is continually refined, in consultation with multiple stakeholders including the World Health Organization, NGOs, governments, universities and institutional investors. The Index is funded by the Bill & Melinda Gates Foundation, the Dutch Ministry of Foreign Affairs and the UK Department for International Development.