Real estate plays crucial role in rapidly-evolving retail strategies, says report by Jones Lang LaSalle

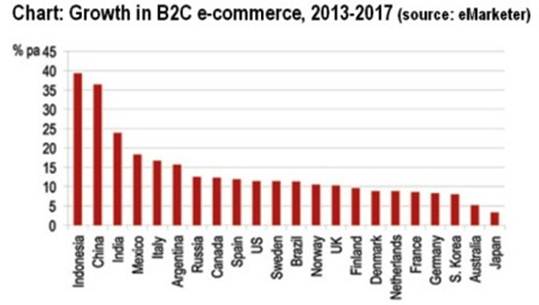

Indonesia, China and India are set to experience the highest rates of B2C e–Commerce sales growth by 2017. A new report from Jones Lang LaSalle highlights the crucial role that the logistics property sector will play in Asia Pacific and how it must adapt to changing consumer demand.

Executive Summary:

Global online sales currently account for four percent of total retail sales and are growing at a rapid pace. In fact, global online sales grew 14.8 percent per annum from 2007 to 2012 compared to total retail sales, which increased by just 0.9 percent during the same period.

Although developing economies currently lag behind developed economies in their e-commerce infrastructure, they may see stronger e-commerce sales growth in the future. As a result, the global e-commerce landscape will change rapidly over the next five years and beyond.

By 2017, the highest rates of B2C e-commerce sales growth are predicted to occur in Indonesia, China, India and Mexico. In contrast, growth rates in mature markets will be measured, although markets such as the U.S. and UK are still expected to post annual double-digit growth rates.

Retailers are in a quandary about their international e-commerce expansion plans. Do they invest resources into developing countries with poor logistics infrastructure knowing that they may not see ROI for five years, or concentrate on mature markets, where there is already strong competition for both e-commerce users and premium industrial space, but an established logistics infrastructure?

E-commerce In Developed Countries:

For developed countries, omni-channel retail strategy is driving major changes in e-commerce logistics models. In an omni-channel strategy, which seamlessly integrates sales channels such as the store, web and/or mobile, consumers can choose the most convenient way to order, receive and return their purchases. Models differ across the globe:

- In the United Kingdom, and other developed markets, ‘click and collect’ is the fastest growing component of many retailers’ online sales, driven by consumer preferences for the convenience of collection over home delivery.

- Germany is Europe’s second-largest e-commerce market by turnover after the UK. E-commerce growth has led to significant new demand for large e-fulfillment facilities, driven by pure-play retailers.

- As the Australian e-commerce sector matures and automation increases, ‘specialized’ or ‘purpose-built’ real estate will become common. Parcel lockers are becoming more widespread, as well as companies offering easy deliveries and returns using existing infrastructure for drop-off points.

- In the U.S., it is estimated that 30 percent of industrial big box warehouse demand is correlated to e-commerce. Retailers continue to open large e-fulfillment centers in close proximity to major markets; they are also opening mid-sized warehouses operated by third-party logistics providers in secondary markets to meet same day delivery needs across the country.

E-commerce In Emerging Economies:

In emerging markets, e-commerce supply chains are evolving in highly divergent ways, influenced by regulatory, economic and cultural factors:

- In China, the first wave of e-commerce warehouse space was concentrated in tier-one cities such as Beijing, Shanghai and Guangzhou, but since 2011 major e-commerce firms are setting up distribution centers in emerging inland retail markets too.

- With more than 100 million internet users in Brazil, the boom in e-commerce has created new demand for warehouses, particularly in São Paulo, Brazil’s main logistics hub. Logistics clusters are emerging on the major roads that lead to the city in locations such as Barueri, Cajamar and Guarulhos.

- In India, online retail accounts for less than one percent of total retail spending. E-commerce-related warehousing is designed to serve tier-one cities. The country’s multiple tax structure has encouraged decentralized warehouse networks with small state-based facilities. However, the soon-to-be implemented Goods and Services Tax (GST) will encourage consolidation of distribution networks and will fuel demand for larger distribution centers.

Eventually emerging markets may surpass mature markets in pure volume owing to the size of their population. E-commerce gives retailers the potential to reach new customers that physical locations cannot, particularly in remote, rural locations. As more and more consumers embrace e-commerce as a safe and convenient way to purchase goods, retailers in developing countries will invest in logistics models exposing new products to new populations