Presentation at the GfK “Point of Sale” conference in Cologne, Germany

Presentation at the GfK “Point of Sale” conference in Cologne, Germany

Bruchsal, Germany, April 29, 2014 – GfK completed a comprehensive analysis of the European retail scene and a prognosis for 2014. GfK presented the study to representatives of the retail sector at the GfK “Point of Sale” conference in Cologne, Germany on April 29, 2014. The study is now available from GfK’s website.

GfK recently released a new study on European retail in 2014. The study provides a Europe-wide overview of retail-relevant data. The following GfK market indicators were evaluated for a total of 32 European countries: GfK Purchasing Power, retail turnover and the retail share of the population’s total expenditures. GfK also offers a forecast for retail turnover in 2014 and consumer price trends. The study examines the sales area provision and productivity in the European countries under review and includes a four-page analysis of Poland’s dynamic retail market.

“Some very interesting trends continue to characterize the European retail landscape,” explains Dr. Gerold Doplbauer, GfK retail expert and study leader. “Broadly considered, 2013 was a period of slowed economic momentum, marked by diminishing purchasing power growth. The retail trade suffered turnover losses as a result of these conditions. Stationary sales declined more noticeably amidst rising retail prices. However, for 2014, we anticipate accelerated economic growth in Europe as well as a stabilization of the situation in Greece and Southern Europe. European retail will profit from this development, but the specific effects will vary substantially from country to country, as the study shows.”

Below are some of the key findings of the study:

• Purchasing power: A total of €7.6 trillion was available to consumers in the EU-28 for consumption-related expenditures in 2013. This equates to an average per-capita purchasing power of €15,017. The purchasing power for all 32 countries considered by the study amounts to around €9.3 trillion. With a total 2013 growth of +0.6 percent in the EU-28, purchasing power lagged significantly behind levels in recent years. The greatest declines in purchasing power took place in Greece (-8.4 percent), Cyprus (-7.4 percent) as well as in the Czech Republic and Slovenia (-2.4 percent for both). Purchasing power also fell again in Italy and Spain in 2013. However, slight growth is expected in these areas for 2014.

• Stationary retail turnover in 2013: In 2013, stationary retail turnover stagnated at around €3.1 trillion (-0.1 percent) in the 32 countries considered by the study. Further retail losses were suffered by Greece (-7.9 percent), Cyprus (-5.1 percent), the Netherlands (-3.6 percent), Spain (-3.5 percent) and Italy (-3.4 percent). The rankings of Europe’s largest retail markets remained unaffected by this and are still led by Russia, followed by France and Germany.

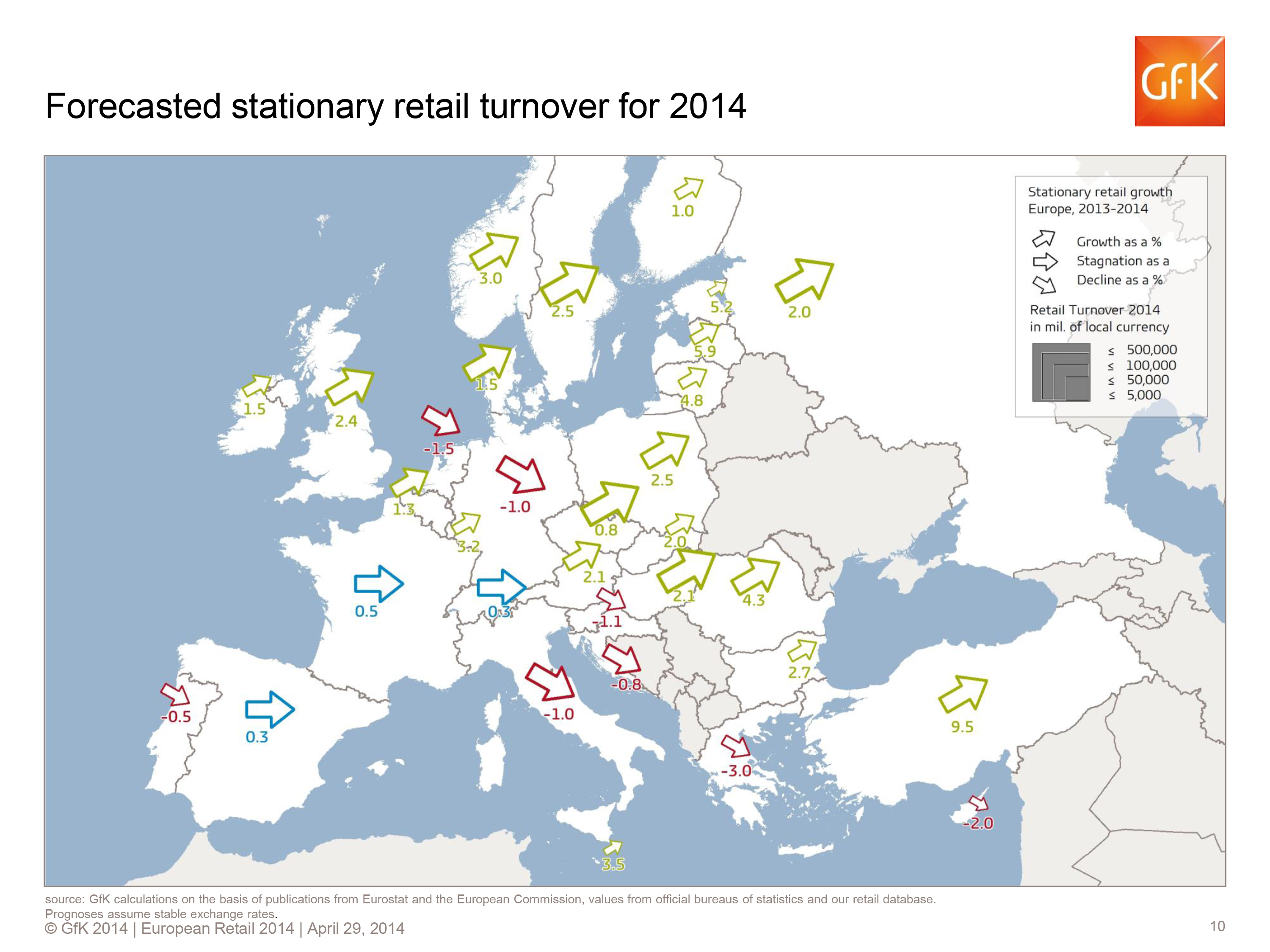

• Turnover prognosis for 2014: Growth in online trade is placing increasing pressure on stationary retail throughout Europe. GfK consequently predicts only moderate stationary retail growth of +0.6 percent (on average) for the EU-28 in 2014. Frontrunners include Romania (+4.3 percent) and the Baltic states (+4.8-5.9 percent). GfK expects that the retail situation will begin to stabilize in the economically hard-hit countries in Southern Europe in 2014.

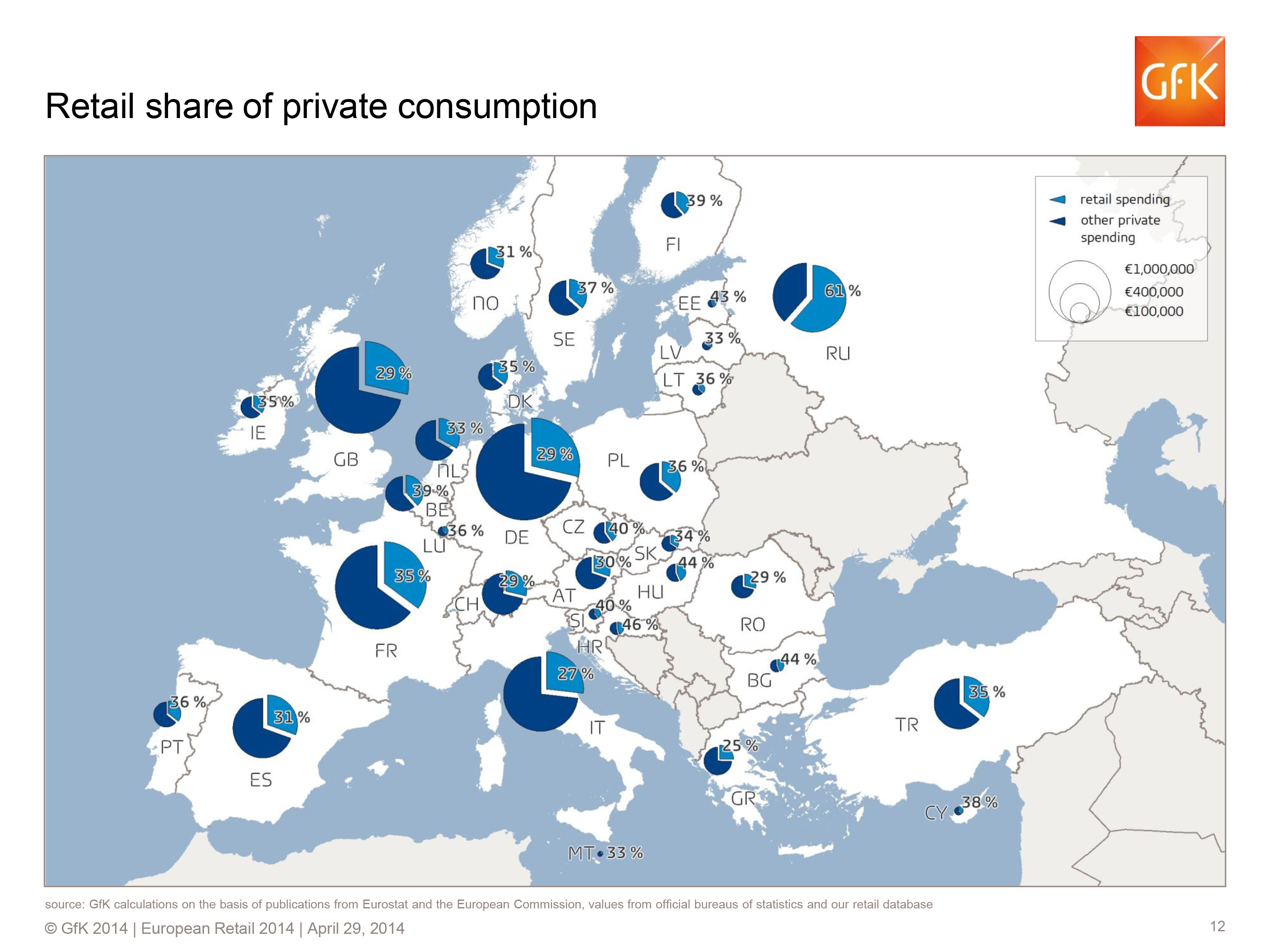

• Retail share of private consumption in 2013: This share declined again in 2013 among the EU-28; the quota is now at 30.8 percent. Reasons for the continuing decline in the retail share of consumption include rising costs for energy, accommodation and leisure activities. The retail share is notably low in Italy (26.8 percent) and Greece (25.3 percent) as a result of the economic crisis. The strong economies of Germany, Great Britain and Switzerland have a retail share of just under 29 percent. A key reason for this low percentage are the higher incomes, of which a comparatively smaller portion suffices to cover basic needs.

• Inflation: The average rate of inflation in the EU-28 countries has been in continuous decline in recent years. However, there are significant differences between the countries reviewed by the study. While Greece underwent a deflation in 2013 (-0.9 percent), prices remained stable in Latvia (+/-0 percent) and Switzerland (+0.1 percent). By contrast, consumer prices rose sharply in Russia (+5.0 percent) and Turkey (+7.5 percent). The inflation rate in 2013 was between 0.4 percent and 2.2 percent among the majority of the countries considered by the study. The currently already low rate of inflation is predicted to sink further in 2014 (to an average of 1.2 percent in the EU-28).

• Per-capita sales area: The 32 researched countries have a 2013 per-capita sales area of 1.11 m², which is a +1.9 percent increase over the 2012 value. The greatest growth occurred in northern and eastern European countries such as Finland, Bulgaria, Romania and Estonia. By contrast, sales area declined in some countries, particularly Greece. Germany also lost sales area in 2013 as a result of the closing of numerous home improvement stores. But Germany’s per-capita sales area increased nonetheless due to its declining population.

About the study

GfK’s calculations of turnover and purchasing power were carried out in euros based on the average 2013 exchange rate for the national currencies in question (as reported by the ECB). The press deadline for preparation of the information and data was March 2014.

About GfK

GfK is the trusted source of relevant market and consumer information that enables its clients to make smarter decisions. More than 13,000 market research experts combine their passion with GfK’s 80 years of data science experience. This allows GfK to deliver vital global insights matched with local market intelligence from more than 100 countries. By using innovative technologies and data sciences, GfK turns big data into smart data, enabling its clients to improve their competitive edge and enrich consumers’ experiences and choices.

Additional information can be found at www.gfk.com