SAN MATEO, Calif., May 1, 2014 – Worldwide tablet plus 2-in-1 shipments slipped to 50.4 million units in the first calendar quarter of 2014 (1Q14) according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker. The total represents a sequential decline of -35.7% from the high-volume holiday quarter and just 3.9% growth over the same period a year ago. The slowdown was felt across operating systems and screen sizes and likely points to an even more challenging year ahead for the category.

SAN MATEO, Calif., May 1, 2014 – Worldwide tablet plus 2-in-1 shipments slipped to 50.4 million units in the first calendar quarter of 2014 (1Q14) according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker. The total represents a sequential decline of -35.7% from the high-volume holiday quarter and just 3.9% growth over the same period a year ago. The slowdown was felt across operating systems and screen sizes and likely points to an even more challenging year ahead for the category.

“The rise of large-screen phones and consumers who are holding on to their existing tablets for ever longer periods of time were both contributing factors to a weaker-than-anticipated quarter for tablets and 2-in-1s,” said Tom Mainelli, IDC Program Vice President, Devices and Displays. “In addition, commercial growth has not been robust enough to offset the slowing of consumer shipments.”

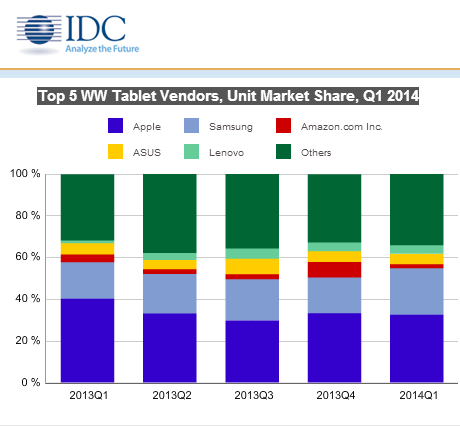

Apple maintained its lead in the worldwide tablet plus 2-in-1 market, shipping 16.4 million units. That’s down from 26.0 million units in the previous quarter and well below its total of 19.5 million units in the first quarter of 2013. Despite the contraction, the company saw its share of the market slip only modestly to 32.5%, down from the previous quarter’s share of 33.2%. Samsung once again grew its worldwide share, increasing from 17.2% last quarter to 22.3% this quarter. Samsung continues to work aggressively with carriers to drive tablet shipments through attractively priced smartphone bundles. Rounding out the top five were ASUS (5%), Lenovo (4.1%), and Amazon (1.9%).

“With roughly two-thirds share, Android continues to dominate the market,” said Jitesh Ubrani, Research Analyst, Worldwide Quarterly Tablet Tracker. “Although its share of the market remains small, Windows devices continue to gain traction thanks to sleeper hits like the Asus T100, whose low cost and 2-in-1 form factor appeal to those looking for something that’s ‘good enough’.”

Top Five Tablet Vendors, Shipments, and Market Share, First Quarter 2014 (Preliminary Results, Shipments in millions)

| Vendor |

1Q14 Unit Shipments |

1Q14 Market Share |

1Q13 Unit Shipments |

1Q13 Market Share |

Year-over-Year Growth |

| Apple |

16.4 |

32.5% |

19.5 |

40.2% |

-16.1% |

| Samsung |

11.2 |

22.3% |

8.5 |

17.5% |

32.0% |

| ASUS |

2.5 |

5.0% |

2.6 |

5.4% |

-2.8% |

| Lenovo |

2.1 |

4.1% |

0.6 |

1.3% |

224.3% |

| Amazon.com Inc. |

1.0 |

1.9% |

1.8 |

3.7% |

-47.1% |

| Others |

17.2 |

34.2% |

15.5 |

31.8% |

11.5% |

| Grand Total |

50.4 |

100.0% |

48.6 |

100.0% |

3.9% |

Source: IDC Worldwide Quarterly Tablet Tracker, April 30, 2014

Note: Total tablet market includes slate tablets plus 2-in-1 tablets.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. In 2014, IDC celebrates its 50th anniversary of providing strategic insights to help clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com