HEG Ltd. is engaged in manufacturing of graphite electrodes with an installed capacity of 80000TPA, backed by a captive power generation capacity of 77MW. Superior product mix coupled with technological competence and cost efficiency has enabled it to enjoy strong operating margin in the industry. Power constitutes over 20% of the total operational cost in graphite electrodes manufacturing, and hence, HEG’s self-sufficiency in power on account of its captive facilities provides significant cost benefits. We believe disproportionately larger part of the new steel capacities in the next decade will be based on Electric Arc Furnace (EAF) route due to rising environmental concerns and scrap generation in China. The industry has high entry barriers due to significant consolidation, which places HEG in an advantageous position.

HEG Ltd. is engaged in manufacturing of graphite electrodes with an installed capacity of 80000TPA, backed by a captive power generation capacity of 77MW. Superior product mix coupled with technological competence and cost efficiency has enabled it to enjoy strong operating margin in the industry. Power constitutes over 20% of the total operational cost in graphite electrodes manufacturing, and hence, HEG’s self-sufficiency in power on account of its captive facilities provides significant cost benefits. We believe disproportionately larger part of the new steel capacities in the next decade will be based on Electric Arc Furnace (EAF) route due to rising environmental concerns and scrap generation in China. The industry has high entry barriers due to significant consolidation, which places HEG in an advantageous position.

Investment Rationale

Increased capacity and better realization to boost top-line and margin

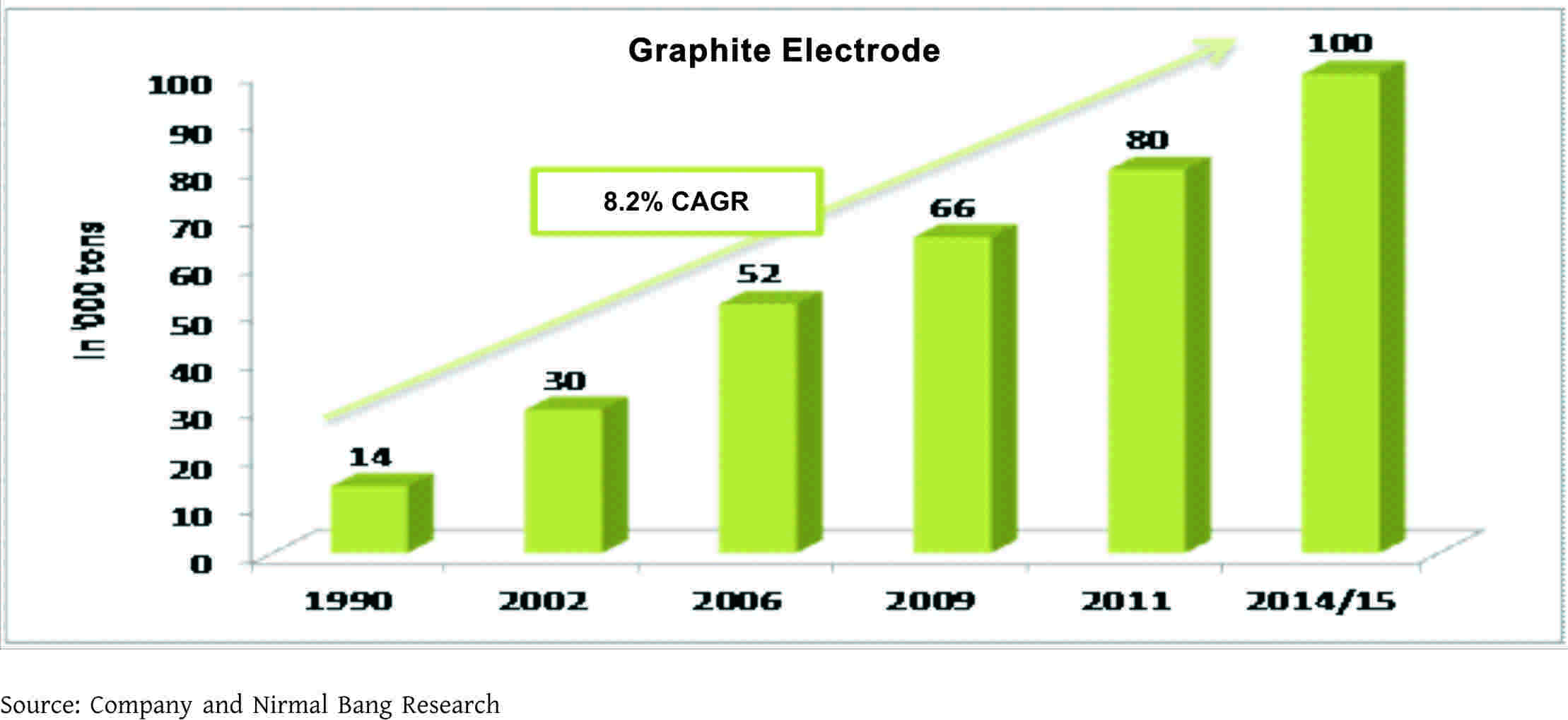

With the increase in shift from Blast Furnace (BF) route to EAF route by steelmakers, the demand for graphite electrodes is seen increasing over a period of time. HEG, being a leading player has en-cashed this opportunity by adding capacity in the graphite electrodes from 24000MT in 2000-01 to 66000MT in 2010-11 to 80000MT in 2011-12. HEG has invested Rs. 225 crores for increasing the capacity to 80000MT which was funded through a combination of internal accruals and debt.

According to the management, the average price realization has improved by 8-10% in CY2012 which will improve the operating margin going forward.

Increase in EAF route by steelmakers will boost the revenue growth

The EAF method of manufacturing steel is becoming increasingly attractive due to its low capital costs, lower break-even tonnage, and flexibility in locating plants closer to consumption points and significantly lower pollution levels than in the blast furnace steel plants.

Projected Growth of Total World Steel & EAF Steel

Reason for the higher growth in EAF:

? Environment considerations

? Lower investments

? High flexibility of operations

? Uncertainty over coal and iron prices for Blast Furnaces

? Scrap availability – rapid increase in collection of Steel Scrap in China and other Asian countries

? Lower growth in Steel demand doesn’t justify large new BOF’s

Graphite Electrode essentially finds it application in EAF route of steel making, where steel scrap is melted. The demand for graphite electrode is, therefore, sensitive not to steel prices, but to steel production volumes through the EAF route. Globally, the steel manufacturing companies have increased the usage of EAF route for steel making process that has augmented the demand of Graphite Electrodes. The uncertainty in the iron ore prices has prompted steelmakers to shift to different routes of steel making like EAF which requires steel scrap to manufacture steel. Also unlike other costly inputs, electrodes account for 2% of steel production costs.

UHP Graphite Electrodes Industry Overview (No New Capacity Addition in the international market)

Interestingly, while global capacities have been stagnant over the past decade, HEG and Graphite have increased their capacity.

Going forward it is expected that the increasing usage of the EAF route for steel making process would further lead to an increase in the demand of the Graphite Electrode globally.

Increase in availability of raw-material

Needle coke is primarily applied in graphite electrode for electric furnace steelmaking (EAF), lithium batteries, nuclear power, aerospace, etc. Needle coke, the key raw material, is manufactured by very few companies worldwide and is a by-product of oil refinery. As nearly 70% of the global production is controlled by US based oil major, the supply is highly concentrated, thereby posing a risk of sharp swing in prices as well as uncertainty of delivery schedule and quantity.

Since 2009, the global demand for needle coke has quickly rebounded in the wake of recovery of its downstream sectors. In the same period, the global needle coke giants haven’t substantially expanded capacity in order to take price advantage, which has caused sustained tension supply in the world’s needle coke market. To mitigate some of these risks, electrode manufacturers normally lock their yearly requirement prior to the beginning of New Year, by getting into a full year volume contract with prices being fixed on annual basis. As needle coke constitutes around 50% of the total raw material cost, any spike in the prices of same has the potential to significantly impact the margins of the electrode manufacturer.

With the few suppliers of needle coke in the market, HEG has to depend on them for its uninterrupted supply of needle coke which is the most important raw material used in the production of graphite electrodes. As the raw-material supply is controlled by few, it plays a significant role in determining profit margins for graphite players. The graphite player does not enjoy any bargaining power and thus have to pay the price determined by the needle coke suppliers. However, the graphite players can easily pass on the hike in cost to its customers as graphite electrodes form just around 2-3% of a steel manufacturer cost, they don’t mind paying a higher price for the product. This is because; there is no substitute available for graphite electrodes and the EAF steel manufacturer must use graphite electrodes to keep their factories running. As there are only few graphite electrodes players worldwide, the EAF steel manufacturers have to pay the price asked by players like HEG.

Strong entry barrier

Graphite electrodes are used in EAF based steel mills and is a consumable item for the steel industry. The graphite electrode industry is highly consolidated with the top five major global players accounting for 75% of the high end UHP electrode capacity. The manufacturing process, for the high end UHP electrodes is technology intensive and is a significant barrier for the entry of new players.

According to the industry, to set up a green-field plant, a new entrant requires a capex of Rs. 1000 crore for setting up a 30000 ton capacity. We have assumed a debt/equity ratio of 70:30. In order to make ROE of 15% (industry average), the project’s desired PAT is Rs. 45 crores. The reverse calculation suggest that company would need to achieve EBITDA of Rs. 201 crore (tax rate 33%, Interest rate 12% and depreciation rate 5%) in order to make this kind of PAT. At this EBITDA level, company would need to achieve EBITDA/ton of Rs. 74,444 (assuming 90% capacity utilization). HEG EBITDA per ton for the last five years stood at Rs. 54,358 while international players are also making EBITDA/ton in the similar range or lower. At Rs. 50,000 per ton of EBITDA, the company would be just break-even at PAT level. The low EBITDA per ton and high capex costs discourages the new entrant in the market.

Here we would like to highlight, HEG has increased its capacity to 80000TPA with an investment of Rs. 225 crores. To further expand it to 100000TPA (additional 20000TPA), HEG would have to invest just Rs. 200 crores.

Despite being relatively smaller than global majors, HEG enjoys the similar kind of EBITDA per ton in the industry on account of its product range (high margin, value added UHP Graphite Electrodes), superior technology and low production cost. Overall, with the increased capacity, rising global demand for graphite electrode coupled with the insulated raw material supply position, the outlook of graphite industry seems positive in near future.

Ruchita Maheshwari

Equity Research Analyst