KOLKATA – October 9, 2014 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report today on third quarter funding and mergers and acquisitions (M&A) activity for the solar sector in 2014.

KOLKATA – October 9, 2014 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report today on third quarter funding and mergers and acquisitions (M&A) activity for the solar sector in 2014.

Total global corporate funding in the solar sector, including venture capital (VC), private  equity (PE), debt financing, and public market financing raised by public companies, jumped to $9.8 billion, compared to $6.3 billion in Q2 2014. This quarter also saw the third yieldco Initial Public Offering (IPO) so far this year, the $577 million IPO of TerraForm Power, a yieldco subsidiary of SunEdison.

equity (PE), debt financing, and public market financing raised by public companies, jumped to $9.8 billion, compared to $6.3 billion in Q2 2014. This quarter also saw the third yieldco Initial Public Offering (IPO) so far this year, the $577 million IPO of TerraForm Power, a yieldco subsidiary of SunEdison.

Raj Prabhu, CEO of Mercom Capital Group, commented, “Financing activity was strong all around this quarter whether you look at VC, debt or public markets, and it was the best fundraising quarter since Q1 2011. VC funding in solar has now crossed $1 billion in the first three quarters this year.”

VC/PE

Global VC/PE funding, in Q3 2014 totaled $326 million in 21 deals, down from $452 million in 22 deals in Q2 2014. Like the previous quarter, solar downstream companies attracted most of the VC funding in Q3, with $205 million in 11 deals.

The largest VC/PE deal in Q3 2014 was the $110 million raise by Sunnova Energy, a provider of residential solar service to homeowners through its network of local installation partners offering leases and PPAs. Glasspoint Solar, a provider of solar steam generators to the oil and gas industry for applications such as Enhanced Oil Recovery, raised $53 million. Other Top 5 deals included the $40 million raised by PosiGen, a US-based provider of solar lease, purchasing and energy efficiency upgrades, followed by Solexel, a developer of crystalline silicon solar cells and modules, which raised $31 million. Ygrene Energy Fund, a provider of residential and commercial property assessed clean energy (PACE) financing, raised $30 million.

Public Market Financing

Public market financing in Q3 totaled $987 million including one IPO compared to $1.3 billion in Q2.

Debt Financing

This quarter also saw strong debt financing activity dominated by Chinese deals totaling $8.5 billion compared to $4.6 billion in Q2.

Project Funding

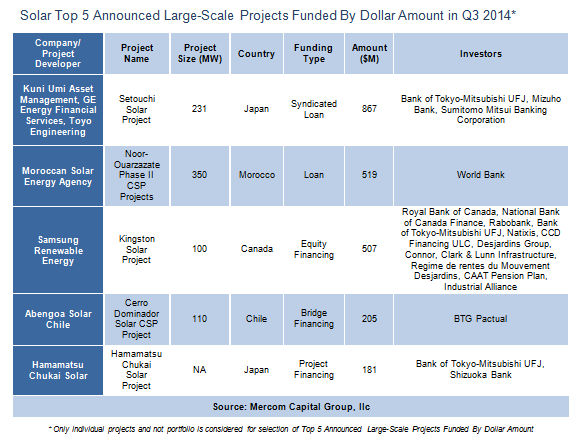

There were 35 large-scale project funding deals totaling $3.7 billion announced in Q3 2014. The Top 5 large-scale project funding deals in Q3 2014 included the $867 million raised by Kuni Umi Asset Management, GE Energy Financial Services and Toyo Engineering for the 231 MW Setouchi Solar Project in Japan, Moroccan Solar Energy Agency’s $519 million loan raise for their 350 MW Noor-Ouarzazate Phase II CSP Project in Ouarzazate, followed by Samsung Renewable Energy’s $507 million raise for the development of the 100 MW Kingston solar project in Canada, the $205 million raise by Abengoa Solar Chile for its 110 MW Cerro Dominador solar CSP project in Chile, and the $181 million raise by Hamamatsu Chukai Solar for the Hamamatsu Chukai solar project in Japan.

Residential/Commercial Solar funds

Third-party residential and commercial solar funds witnessed a decline in Q3, with only $590 million raised, compared to $1.3 billion in Q2, but on par with Q3 of last year.

Corporate M&A

There were 32 corporate M&A transactions in the solar sector in Q3, up from 25 transactions in Q2 2014. Solar downstream companies accounted for most of the M&A transactions with 18.

The largest disclosed M&A transaction by dollar amount was the $200 million acquisition of GRAPP Energies, an Indian EPC and turnkey solutions provider in renewable energy, and its subsidiary Green Ripples, by Solargise, a UK-based solar project developer. This was followed by the $150 million acquisition of the space photovoltaics business of EMCORE, a provider of semiconductor-based components, subsystems and systems for fiber optics and space solar power industries by Veritas Capital, a private equity firm, through its affiliate. Shunfeng Photovoltaic International, a Chinese manufacturer of solar cells, silicon wafer and solar modules, through its German subsidiary SF Suntech Deutschland, acquired the operative business including all assets of S.A.G. Solarstrom, a German solar project developer, for $85.6 million.

Just Energy, a retailer of natural gas and electricity, agreed to sell its commercial solar development business Hudson Energy Solar (Hudson Solar) to a global energy company for $56 million. Rounding out the Top 5 was the acquisition by Direct Energy, an energy services company, of Astrum Solar, a full-service residential solar installer, for $54 million.

Project Acquisition

Project acquisitions in Q3 2014 totaled $582 million in 38 transactions with 1.2 GW changing hands. The top disclosed project acquisition by dollar amount was BluEarth Renewable’s acquisition of the 10 MW Good Light solar project located in Canada from Canadian Solar for $60.3 million. This was followed by the sale of the 20 MW Gonghe County Xinte solar project in China by TBEA SunOasis (TBEA) and Xinjiang Sangou Solar Equipment (Xinjiang Sangou) to United Photovoltaics for $35 million. NextEnergy Solar Fund (NESF) acquired a special purpose vehicle, which owns the 14.9 MW Ellough solar project in the UK, from Lark Energy for $30.5 million. The fund also acquired the 12.5 MW Bilsham Phase I solar project from BNRG Renewables for $26 million, together with the 14.5 MW Poulshot solar project from Hive Energy, for $25 million.

Mercom also tracked 175 new large-scale project announcements in various stages of development worldwide in Q3 2014 representing 10.3 GW.

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and research and consulting firm focused exclusively on clean energy and financial communications. Mercom delivers widely read industry market intelligence reports covering Solar Energy, Wind Energy and Smart Grid. Our reports provide timely industry happenings and ahead-of-the-curve analysis specifically for C-level decision making. Mercom’s consulting division advises cleantech companies on new market entry, custom market intelligence and overall strategic decision-making. Mercom’s communications division helps clean energy companies and financial institutions build powerful relationships with media, analysts, government decision-makers, local communities and strategic partners. For more information about Mercom Capital Group, visit: http://www.mercomcapital.com. To get a copy of Mercom’s popular market intelligence reports, visit: http://mercomcapital.com/market_intelligence.php