NEW YORK – Celent has released a new report titled Top Trends in Corporate Banking: From Disruption to Transformation. The report was written by Alenka Grealish, a Senior Analyst with Celent’s Banking practice.

Their mantra is easier and faster: easier and faster to do business with them (e.g., customer onboarding, self-service, digitization of manual processes) and easier and faster to innovate and harness emerging technology

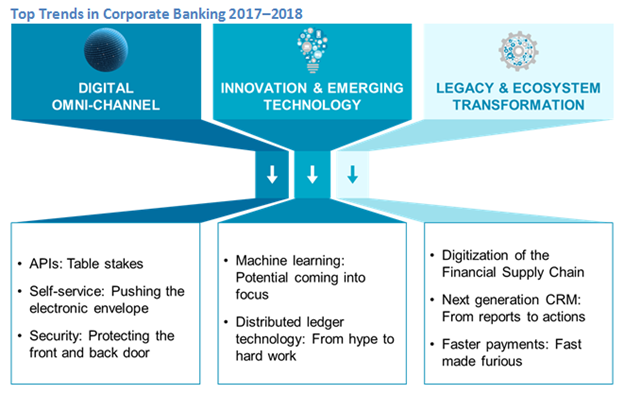

Transformation is occurring in three overarching areas: integration of corporate banking tech infrastructure, digitization of customer journeys, and open banking and partnerships. Banks in the forefront are focusing on digitizing end-to-end processes and are shifting from a product-centric to a customer workflow view. They are also embracing collaboration with third-parties and are harnessing the potential of open banking. In the process, they are opening their minds to selective coopetition and cannibalization. Celent sees five critical trends in the digital and emerging technologies: APIs are becoming table stakes, self-service improvements are paramount to differentiation, security fortifications include biometrics and advisory services, machine learning applications are becoming viable, and distributed ledger technology is entering the “hard work” period.; In banks’ continuing quest to modernize their technology infrastructure, Celent expects to see growing energy directed in three areas: digitization of the financial supply chain, next generation CRM, and faster payments.

“Bankers should embrace select aspects of a “Day 1” culture: be data-driven, challenge the status quo by continually revisiting strategy and tactics, avoid sacred cows,” commented Grealish.

“Bankers should break from the traditional view of a bank and its products/services as a walled garden and develop an open banking strategy in which the bank partners with third-parties to manufacture and/or distribute better products and services and embed themselves into customer workflows,” she added.

Exhibit:

About Celent

Celent is a research and advisory firm dedicated to helping financial institutions formulate comprehensive business and technology strategies. Celent publishes reports identifying trends and best practices in financial services technology and conducts consulting engagements for financial institutions looking to use technology to enhance existing business processes or launch new business strategies. With a team of internationally experienced analysts, Celent is uniquely positioned to offer strategic advice and market insights on a global basis. Celent is a member of the Oliver Wyman Group, which is part of Marsh & McLennan Companies [NYSE: MMC].