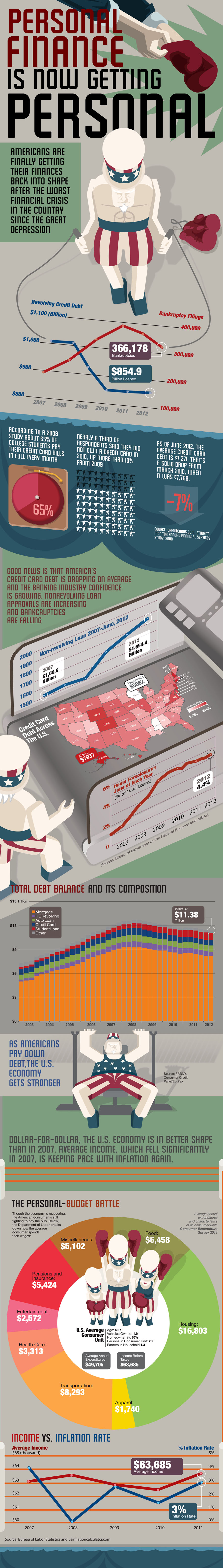

Americans are finally getting their financial house in order following the 2008 financial crisis. We are paying down debt; bankruptcies and foreclosures are down; non-revolving loans are up and we are getting back on our feet.

Below is a great infographic which we invite you to use that highlights how we are getting back on your feet slowly but surely. Here are a few stats

- · Credit card debt on average is down 7%

- · bankruptcies and foreclosures are down

- · non-revolving loans are up from $1.5B in 2007 to $1.85B in 2012

- · Total debt balance peaked in 2008 over $12 trillion and today its down to $11.3 trillion

- · If you are ever on Jeopardy: Alaskans have the highest per person credit card debt ($7,937) and Wisconsin has the least ($5,062)?