Luxembourg, August 1st, 2013 – ArcelorMittal today announced results for its Flat Carbon Europe segment for Q2 2013.

Luxembourg, August 1st, 2013 – ArcelorMittal today announced results for its Flat Carbon Europe segment for Q2 2013.

The segment recorded an operating loss of €151 million for Q2 2013 which excludes interest and tax costs. This includes restructuring costs totalling €119 million mainly associated to the asset optimisation of the liquid phase in Florange, France. This is compared to an operating loss of €43 million in Q1 2013 that had included €72 million income from DDH (Dynamic Delta Hedge).

Operating loss for H1 2013 (€194 million) decreased by 49% compared to H1 2012 (€340 million).

- Compared to Q1 2013, the segment’s crude steel production increased 2.8% to 7.5 Mt in Q2 2013 benefiting from the full quarter operations of the blast furnaces at Asturias and Dunkerque, restarted after regular maintenance.

- Steel shipments in Q2 2013 were 7.1 million tonnes, an increase of 2.6% as compared to 6.9 million tonnes in Q1 2013 due a seasonal recovery.

- Sales in the Flat Carbon Europe segment increased to €5.3 billion in Q2 2013 as compared to €5.2 billion in 1Q 2013, primarily due to higher steel shipment volumes.

- Capital expenditure in the segment for Q2 2013 was €80 million.

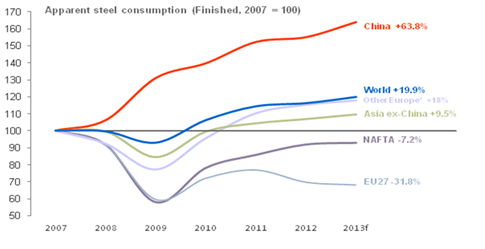

After six consecutive quarters of contraction, Eurozone GDP is likely to have stabilised in Q2 2013. Consequently, underlying steel demand in Europe is approaching stabilisation.

The rate of decline in the construction market is beginning to slow down and the July PMI for the Eurozone is expected to be back above 50 for the first time in two years.

Automotive sales hit a low in June, declining by 5.5% year-on-year as all major markets declined except the UK. However, there are signs that sales are bottoming out, and we expect an end to year-on-year declines soon.

Mild growth is expected in H2 2013, driven by a pick-up in trade and stabilising consumption. However, despite support from a smaller decline of inventories, Eurozone steel demand is still expected to decline by 1.5%-2.5% in 2013.

Robrecht Himpe, CEO of Flat Carbon Europe and member of the ArcelorMittal Management Committee, said “We are seeing a noticeable improvement in the results of Flat Carbon Europe operations despite the continued drop in European steel demand. This can largely be attributed to the proactive steps we took to optimise our asset base in Europe in order to improve efficiency and competitiveness. Despite steel demand in Europe beginning to stabilise, some key markets such as automotive and construction, remain difficult. I believe that our adapted operating asset base in Europe will enable us to continue to focus on providing to our customers value and quality products, which are vital in order to continue our recovery in Europe.”