Ashutosh Limaye, Head – Research & REIS, Jones Lang LaSalle India

Ashutosh Limaye, Head – Research & REIS, Jones Lang LaSalle India

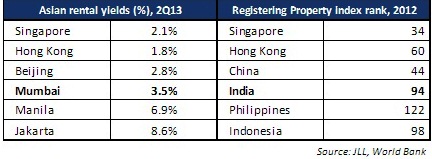

Residential rental yields* across Tier I cities in Asia have an interesting story to tell. While yields in India are higher than in Singapore, Hong Kong and Beijing, they are lower than in cities such as Jakarta and Manila. Several factors are responsible for this – the local demand-supply situation, macro-economic scenario, end-user demand, local land-related policies, etc.

Does this yield variation in Asian cities clearly reflect the risk-return trade-off? The World Bank’s Registering Property index (part of its Doing Business index) provides some insights.

The Registering Property index ranks India at 94 among 185 surveyed countries. China, Hong Kong and Singapore rank higher than India, while Indonesia and Philippines rank lower. Both Indonesia and Philippines are perceived as having relatively weak legal frameworks. This clearly shows that weakness in the legal framework is directly indicative of higher the risk – and therefore higher yield:

This differential in rental yields is a crucial consideration for global investors for whom the diversification of markets is an important criterion. Also, higher yields in Asia might tempt global investors, particularly from the West, to invest while they have access to cheaper funds onshore. Local investors also benefit, because higher yields mean a rising rental value, offsetting moderated capital values – the former rise faster than the latter.

Rental Yields – Emerging Asian Vs. Developed Markets

The intra-regional comparison of various Asian cities reflects a logical differentiation between rental yields. However, the same logic does not seem to apply in developed markets. It is widely believed that emerging Asian countries are relatively more risky for real estate investment than developed economies. Yet, the rental yields in emerging Asia do not reflect the relative risk-return differential.

For example – residential yields in Mumbai, which are currently around 3.5%, are lower than those observed in London, Tokyo and New York. All these cities rank quite high on the World Bank’s Registering Property index.

Despite stronger regulations and a better legal framework in the developed economies, comparison with emerging Asian yields reveals a different picture. Lower penetration of financial markets, higher inflation and larger population creating a constant demand for housing could be reasons for this.

Also, households in emerging nations generally prefer to channel a large proportion of their savings into physical assets such as gold and real estate. According to India’s central bank data, the country’s household investments in physical assets are over 50% of the total household savings. In a country like the United States, the figure is below 30%.

Based on yields, global investors do display a degree of scepticism over investing in Asian residential property markets. However, domestic investors continue purchasing at lower yields purely for the capital appreciation (typically around 10% p.a. – and definitely higher than inflation) and because of the savings culture.

The question is – how long will this continue? Can the existing yield differential between emerging Asia and developed markets sustain? Over the past few years, rental yields have been on a decline across various Tier I cities in Asia. So far, it has been the faster rise in capital values over rents across much of Asia that has led to a compression in yields.

In Mumbai, yields have fallen by 50-90 basis points (bps) across various precincts during the period 2007-2Q13. After property prices took a beating during the Global Financial Crisis (GFC), they bounced back quickly, resulting in yield compression. More recently, during 1Q11-2Q13, yields have risen moderately, owing to marginally higher growth in capital values over rental values.

Similar trends have been witnessed in Hong Kong, Singapore and Beijing, where rental yields fell by 50-100 bps during the same six-year period. Manila and Jakarta exhibited a similar trend, though the rates of fall were quite different. While rental yields in Manila fell 30-35 bps, the fall was much sharper in Jakarta at 250 bps. This is attributable to the steep rise in capital values beginning 2Q10, which was the result of escalating cost of transaction and construction material.

Rise in capital values occurred even when economies were slowing down from peak growth rates. Mumbai has seen residential property prices surpass the previous peak of 3Q08, and they continue to remain high despite a slowdown in the Indian economy (FY13 GDP growth fell to 5.0% level after averaging ~8.0% growth during FY10-FY12). This has led to concerns about affordability and overheating of the property market in a scenario wherein job creation and income growth have slowed.

Stemming the Tide

Several Asian governments have started taking steps to cool down property prices. In China, the measures have included raising the minimum down payment, raising the interest rate for second home purchase, restrictions on property purchases by non-Chinese buyers, etc. In India, measures to curb speculative buying include the approval and visible fast-tracking of the Real Estate Regulatory Bill, which intends to checking demand-supply imbalances and bring more transparency to the sector. The Singapore government has introduced similar measures to curb the irrational rise in property prices.

In such a scenario, it is hard to foresee further price escalation unless the economies revive or restrictions ease.

Yields Must Reflect True Investment Rationale

In the near term, residential yields in Asian Tier 1 cities will either stabilise or rise marginally as capital value appreciation begins to drag. This is good for the real estate sector in Emerging Asia on the whole, since the current prices and yields do not correctly reflect the actual macro-economic scenario. Any or a combination of three possible scenarios could prevail in the near future –

- Existing high capital values could instigate authorities to further step up efforts to curtail speculation, resulting in a price corrections – or at least stabilisation. Rentals would probably remain unchanged, thereby halting further yield compression.

- Further rise in capital values could boost demand for rental housing, leading to increased rental values. This would stabilise yields if both capital and rental values grow in tandem.

- An increasing number of individual investors hitherto focused on Emerging Asia could switch to investing in other regions (especially developed markets), attracted by higher yield and better amenities. So far, the likelihood of such a sea-change in investor orientation was remote, largely due to the strong cultural preference of Asians for local real estate. We are now looking at a different scenario.

Though the RBI has now curtailed investment by Indians into offshore property, many HNIs and non-resident locals in other Asian countries have already displayed an increasing preference for investing in properties on foreign shores. In Asian countries other than India, such a trend can still lead to fall in domestic property prices, thus putting a floor to yield compression or fuelling gradual rise in yields.

(* Residential rental yields = monthly rental x 12 months / capital value of the property, or the annual rate of return an investor can earn from his capital invested in a property.)