Average Age Of Office Market In Mumbai, Delhi At Par With Singapore At 11 Years

Average Age Of Office Market In Mumbai, Delhi At Par With Singapore At 11 Years

Latest JLL survey reveals that Beijing and Shanghai have the newest office stock in Asia-Pacific

Anuj Puri, Chairman & Country Head, JLL India

The latest JLL survey on the average age of the most expensive office space in 10 Asia Pacific cities reveals that Beijing, Shanghai have the newest office stock followed by Tokyo, Mumbai, Singapore, Delhi-NCR, Seoul, Sydney, Melbourne and Hong Kong.

The survey, which compares 30 buildings with the highest rents in each city, takes into account an equal number of buildings in Delhi’s central business district (CBD) and secondary business district (SBD), with the rest in Gurgaon. The Mumbai basket has most buildings of Bandra-Kurla Complex (BKC), with the rest in SBD-Central and the CBD.

The recent construction boom in China has helped Beijing and Shanghai have the newest office stock (stock-weighted average age of 8 years). Tokyo’s stock averages just 8.4 years, a result of recent and ongoing re-development projects, especially after the 2011 earthquake.

Singapore and India are both 11 years old while Seoul is older at 14 years. In Singapore, a fourth of the current grade-A space in the CBD has been built since 2010, mainly due to new supply in Marina Bay.

Australian offices are the second oldest in the region, averaging about 20 years old. However, the completion of International Towers Sydney in the Barangaroo precinct will lower average stock age in Sydney by three years.

Hong Kong, at 21.6 years, is still at a ‘mellow’ age, going by Asia-Pacific’s regional standard. The reason behind its age is the very limited land supply in the core Central District and most new supply being in periphery CBDs and decentralised areas. The survey included the ICC in West Kowloon in addition to the top-30 buildings.

| City | Total Floor Area (mn sqm, NLA basis) | Average Age (Years) |

| Beijing | 1.64 | 7.9 |

| Shanghai | 1.55 | 8.1 |

| Tokyo | 1.83 | 8.4 |

| Mumbai | 0.59 | 11 |

| Singapore | 1.54 | 11.2 |

| Delhi | 0.46 | 11.5 |

Source: JLL Capital Markets Research

What it means for Mumbai and Delhi

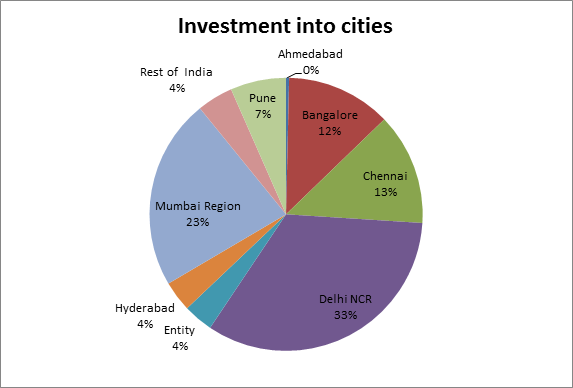

India’s relatively new and inexpensive office space should be attractive to corporate occupiers. Moreover, investors should also look at India if they are looking to buy core/ life expectancy. A JLL study earlier this year had shown how the key Indian metros had attracted an investment of approximately INR 170 billion in 2015. It would not be surprising if this number is surpassed in 2016. Delhi-NCR and Mumbai had attracted the major chunk of this investment.

Source: JLL Capital Markets Research