Suvishesh Valsan, AVP – Research, JLL India

Suvishesh Valsan, AVP – Research, JLL India

The meteoric growth of e-commerce in India in recent years was broadly seen as a threat to physical retail. Seemingly bearing this out, ASSOCHAM states that e-commerce has grown at a compounded annual growth rate (CAGR) of ~30%, while retail sector growth has been at 15% CAGR over the last five years.

However, these fears have little foundation in reality – there is in fact no threat to quality malls (meaning malls with good designs, management practices and healthy tenant mixes). Such malls have actually become more attractive for premium retailers – vacancies have fallen and rentals have increased in such malls. There is, however, no doubt that other shopping centres have suffered a steep decline in footfalls.

Interestingly, many e-commerce companies have started to lease space in quality malls to increase their visibility. Players such as Flipkart, Freecultr and Lenskart have actively pursued this strategy, acting upon their customers’ demands for convenient pick-up / touch-and-feel centres.

E-commerce has witnessed the largest growth in categories such as fashion (apparel, footwear and accessories) and electronics. Consumers prefer established brands in these categories, and choose to buy them from the cheapest sources – often disregarding the point of sale. As e-commerce players started retail activity in these categories, they offered steep discounts – a formula for guaranteed initial success. That said, the ‘deep discount’ strategy cost them dearly, meaning they had to forego profitability in favour of growth. As evidenced by the latest festive season campaigns of e-commerce players, deep discounts are now a thing of the past – meaning that their price advantage over physical retail is eroding.

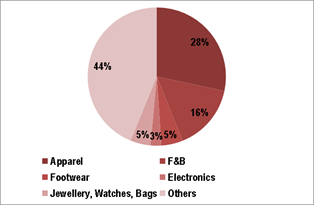

High streets continue to witness dominance of the same retail categories (see chart below), unlike quality malls. However, high streets are left with no novelty factor, as their sole USP of easy access and convenience to consumers is being matched by e-commerce players, which provide home delivery and exchange pick-ups. In such a scenario, high streets could learn from quality malls and not allow e-commerce to become a bigger threat than it currently is.

Source: JLL Research

It would probably help if high streets got more active in initiating holding events or festivals on streets or in designated areas within the area to keep onlookers engaged, thereby inducing shopping. We have seen such events in practice in specific areas like the annual Kala Ghoda art festival in Mumbai and exhibition-cum-sale events of products from various regions of India at Delhi Haat, etc.

By conducting events like these on specific dates, high streets can attract people with similar tastes and preferences, thereby inducing purchases. High streets could also partner with local event planners or festival organisers to promote such activities. Announcing discount seasons during the monsoon, summer, Independence Day, etc. is another strategy which works very well for malls, and can be emulated by high streets to gain an edge over e-commerce players.