SINGAPORE, Aug. 21, 2017 /PRNewswire/ — A report on China’s residential real estate market released by the Royal Institution of Chartered Surveyors (RICS) indicates that debt levels among mainland Chinese residential property developers have accumulated to new historic levels since the onset of the Global Financial Crisis. China’s unprecedented expansion in debt, in terms of volume as well as rate of increase, now exceeds that of Japan’s in the late 1980s, with the possibility of a major credit event becoming more likely in the next two years. The impact of such an eventuality would be felt far beyond China’s domestic property sector – affecting not only China’s future growth trajectory for years to come but also global economic growth at large.

China developers face financing crunch

Based on projected construction schedules[1] as well as the Chinese government’s current credit tightening policy, it is predicted that a spike in construction costs and diminished access to financing will adversely impact the financial situation of Chinese developers from mid-2018. Commenting on the strain to developers’ balance sheets, Sean Ellison, RICS Senior Economist Asia-Pacific said, “Access to cheap credit[2] has resulted in unsustainable land price inflation in China. Residential property developers are now seeing funding avenues dry up as they need to pay for construction on these projects. As we enter 2018, policymakers must decide whether to risk financial contagion in the short-term by allowing some developers to default, or risk inflating the bubble further by continuing to extend credit to the sector.”

Risks to China’s financial system and long-term growth

Notwithstanding the pressure to finance highly inflated land prices amidst tighter lending conditions, Chinese developers also face a growing slew of government restrictions to keep housing prices in check, further straining their balance sheets in ballooning the overall level of leverage, which risks spreading to China’s broader financial system.

This is particularly acute in second tier markets, which have seen an abundance of speculative activity, and among smaller developers, which have less access to traditional financing and are more reliant on the shadow banking system. What remains unknown is how interconnected the shadow and formal banking systems are and whether the prospect of a developer defaulting would spark systemic risk.

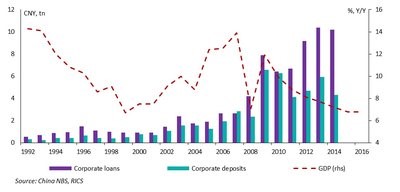

Authorities could attempt to mitigate any crisis in the short term by continuing to extend credit to developers. However, new credit faces diminishing productivity and there is evidence that new lending has been used to pay off old loans. The below chart shows the gap between corporate loans and deposits have steadily increased, meaning that fewer loans are being used to generate real economic activity.

China’s economy at a major inflection point

As China seeks to address vulnerabilities and weaknesses in its economy and financial system and undertake much-needed structural reform against the backdrop of more moderate rates of growth, Chinese policymakers need to confront the realities of excessive debt head-on or reverse its de-leveraging drive and continue support developers with cheap and accessible funding. The former risks destabilising the financial sector, while the latter would likely result in a Japanese-style productivity drain and further inflate asset-price bubbles.

Even as uncertainties mount over China’s efforts to rebalance itself economically and financially, it must be recognised that China is more important than ever for the global economy and has been a critical pillar of global demand since the onset of the Global Financial Crisis. Whatever decisions the Chinese government makes in the next 18 months will have implications that reach far beyond its borders.

[1] Based on normal development schedules, construction is due to begin on these projects. Developers depend on pre-sales from these developments to help offset construction costs — these pre-sales would normally begin from the middle of 2018. As a result of this significant cracks will begin to emerge in developers’ balance sheets.

[2] Flush with funds from easy access to credit, Chinese residential property developers bid up premiums being paid on land prices in 2016 and into the beginning of 2017. As access to credit tightens and house price growth normalizes, the solvency of many of these projects will be tested.