Tech-enabled, fully-automated system will match the pre-defined lender criteria with borrower requirements as soon as they are listed & even send proposals on behalf of lenders

New Delhi, July 26, 2017: In a pioneering development for the country’s fintech sector, Faircent.com, India’s largest peer-to-peer lending platform, has launched a new Auto Invest feature for registered lenders. Poised to be a game-changer for the P2P lending landscape, the Auto Invest feature makes investing easier, less time consuming and ensures that the lender is amongst the first to invest in borrowers that meet their criteria. It eliminates the need for lenders to browse through several borrower profiles by automating the entire process.

Faircent.com provides a highly curated platform that evaluates borrowers based on a fully automated credit evaluation system and lists them among various risk buckets – low to very high. Lenders availing auto-invest can invest any amount starting from Rs. 750/- by setting a maximum range of Rs. 10,000 to Rs. 2 lakhs per proposal across various yield categories and loan tenures. The tech-enabled, fully-automated system will match the pre-defined criteria set by the lender with borrowers’ requirements as soon as they are listed and even send proposals on the lender’s behalf. This will help lenders registered on Faircent build a diversified portfolio across risk buckets more seamlessly and swiftly than was possible earlier.

Commenting on the announcement, Shakti Goel, Chief Technology and Product Officer, Faircent.com said, “Lenders who invest large amounts of money in P2P loans on a regular basis often find it time consuming to view multiple listings and assess individual criteria for each borrower. Auto investment is the future of P2P lending and Faircent.com is capitalising on automation to the fullest to drive a highly tech-driven and simplified experience for lenders on our platform. We are India’s first major P2P lending platform to integrate this technology into the lending process which makes it highly convenient and also enables faster turnaround time. The interface offers easy operability and navigation to review multiple proposals with the final lending decision taken only by the lender.”

With Faircent.com’s unique model, lenders are better poised to generate higher and stable returns on their money as compared to bank deposits or traditional market-linked investment instruments. As per its latest Data & Analytics report, 90% of the lenders on the platform are earning 18% to 26% gross returns. With this revolutionary new addition to its suite of offerings, Faircent now also makes earning these returns more convenient and faster.

About Faircent:

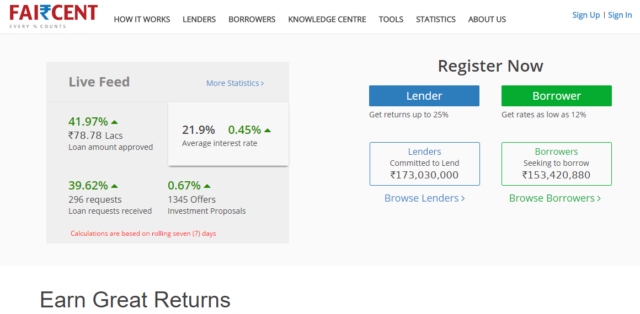

Faircent.com is India’s largest peer to peer lending website which caters to retail and business loans. It is an online platform where, people who have spare money lend it directly to people who want to borrow, thereby eliminating intermediaries and the margins they used to make. Recently, Faircent.com, under the trusteeship of IDBI, created an Escrow account for its lenders to help in faster and smoother flow of funds enabling them to make greater returns on their investments.

In a development which reflects its technological prowess and market leadership, Faircent.com has been awarded the status of a ‘Super Start Up 2017’ by Superbrands. This latest achievement marks another addition in the long list of accolades garnered by Faircent.com for its disruptive and effective business approach. In its nascent history, Faircent.com has been able to garner recognition from the Industry – It was showcased as one of the top start-ups at Start Up India, selected for the first batch of NASSCOM 10,000. It is part of the Microsoft Accelerator Winter Cohort and BizSpark programme and was one of the top 10 companies from India to be selected for Web Summit in 2013. It is the only P2P lending company that has been acclaimed as the ‘Interbrand Breakthrough Brand in Finance’ by Interbrand in its Breakthrough Brands report 2016 in partnership with Facebook, NYSE & Ready Set Rocket. Recently, it was also awarded the NASSCOM Emerge50 given to India’s high potential top 50 emerging companies in different domains.

For More Info Please Visit – https://www.faircent.com/