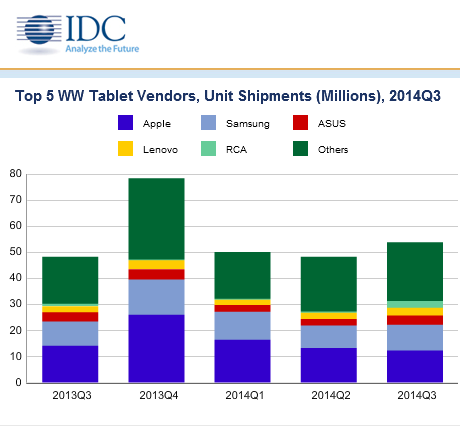

SAN MATEO, Calif., October 30, 2014 – The worldwide tablet grew 11.5% year over year in the third quarter of 2014 (3Q14) with shipments reaching 53.8 million units according to preliminary data from the International Data Corporation (IDC) Worldwide Quarterly Tablet Tracker. Marked by back-to-school promotions and US appetite for connected tablets, the third quarter also saw shipments grow sequentially by 11.2% compared to 2Q14.

“Not only is the US market one of the largest for tablets, but third quarter results also indicate that this is where the growth is,” said Jean Philippe Bouchard, IDC Research Director for Tablets. “We saw Verizon continuing to sell connected tablets at a fast pace, a strategy that we believe other carriers will replicate in following quarters. We also saw RCA enter the top 5, impacting the entire US market and worldwide ranking with one large deal linked to back-to-school and channel fill ahead of Black Friday. Those two elements resulted in the US tablet market growing at 18.5% year-over-year compared to the worldwide market growing at 11.5% annually.”

Despite a continued shipment decline for its iPad product line, Apple maintained its lead in the worldwide tablet market, shipping 12.3 million units in the third quarter. Samsung held its number two position on the market with 9.9 million units shipped, capturing an 18.3% market share in the third quarter. Asus regained its number three position with 3.5 million units and 6.5% share of the market. Lenovo fell back to the number 4 position with 3 million units. It is worth noting that Asus and Lenovo traded the positions they held in 2Q14. The top 5 was rounded out by RCA, which achieved its position by shipping 2.6 million units primarily in one country, the US. Market share for the vendors outside the top 5 continued to outgrow the market, representing 41.8% of total tablet shipments in 3Q14.

“Although the low-cost vendors are moving a lot of volume, the top vendors, like Apple, continue to rake in the dollars,” said Jitesh Ubrani, Senior Research Analyst, Worldwide Quarterly Tablet Tracker. “A sub-$100 tablet simply isn’t sustainable—Apple knows this—and it’s likely the reason they aren’t concerned with market share erosion.”

Tablet Vendor Highlights

Apple, during its earnings call, noted that the iPad’s lifecycle is extending. Combined with consumer anticipation and the release of the latest iPhones, IDC saw a decline in overall iPad shipment volume in 3Q14. Although Apple has recently updated and expanded its iPad lineup to its widest offering ever, IDC still expects 2014 to be the year of the iPhone.

Samsung has slowly begun to focus on markets like North America and Middle East and Africa (MEA), where low-cost Asian vendors haven’t been able to gain a foothold just yet. Although Samsung’s share declined slightly compared to last year, it was able to experience 5.6% growth and was able to maintain its number 2 rank among the top 5.

ASUS was able to leapfrog Lenovo to land itself in the number 3 spot. Much of this gain was fueled by Windows-based 2-in-1 devices as ASUS continues to offer some prominent models at highly competitive prices.

Lenovo‘s strength in emerging markets has been paying off as they experienced greater than 30% growth and have been able to increase their share by almost a percentage point. Lenovo has also had the benefit of leveraging its brand and strength in the PC business to secure a strong position in the tablet market.

RCA. was a surprise entry into the top 5 list due to its distribution deal with some of the largest retailers in the world. With low-cost devices driving volume, RCA’s tablets have been a hit during the back-to-school season and will likely be in high demand during Black Friday and the upcoming holiday season.

Top Five Tablet Vendors, Shipments, Market Share, and Year-Over-Year Growth, Third Quarter 2014 (Preliminary Results, Shipments in millions)

| Vendor |

3Q14 Unit Shipments |

3Q14 Market Share |

3Q13 Unit Shipments |

3Q13 Market Share |

Year-over-Year Growth |

| 1. Apple |

12.3 |

22.8% |

14.1 |

29.2% |

-12.8% |

| 2. Samsung |

9.9 |

18.3% |

9.3 |

19.3% |

5.6% |

| 3. ASUS |

3.5 |

6.5% |

3.6 |

7.4% |

-0.9% |

| 4. Lenovo |

3.0 |

5.7% |

2.3 |

4.8% |

30.6% |

| 5. RCA |

2.6 |

4.9% |

0.9 |

1.8% |

194.0% |

| Others |

22.5 |

41.8% |

18.1 |

37.4% |

24.4% |

| Total |

53.8 |

100.0% |

48.3 |

100.0% |

11.5% |

Source: IDC Worldwide Quarterly Tablet Tracker, October 30, 2014

Notes:

- Data is preliminary and subject to change.

- References to “tablets” in this release include both slate tablets and 2-in-1 devices.

- Vendor shipments are branded shipments and exclude OEM sales for all vendors. The vendor names reflected in this release represent the current parent company (or holding company) for all brands, regardless of the date of mergers or acquisitions.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. IDC helps IT professionals, business executives, and the investment community to make fact-based decisions on technology purchases and business strategy. More than 1,000 IDC analysts provide global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. In 2014, IDC celebrates its 50th anniversary of providing strategic insights to help clients achieve their key business objectives. IDC is a subsidiary of IDG, the world’s leading technology media, research, and events company. You can learn more about IDC by visiting www.idc.com.