- Council to engage in dialogue with Govt. to roll back excise duty & facilitate ease in business

- Council avoids strike/protest; yet morally supports GJF & gems & jewellery trade associations

Gems and Jewellery Export Promotion Council (GJEPC) today stated that the imposition of 1% excise duty on jewellery (other than plain Silver jewellery) by the Government of India in Union Budget 2016-17 is not in the interest of the industry. GJEPC Chairman has already approached the Government to initiate meetings with the Finance Minister and Officials of the Finance Ministry and also the Commerce Minister & Commerce Ministry to persuade them to rollback their decision of imposition of excise duty on jewellery.

Gems and Jewellery Export Promotion Council (GJEPC) today stated that the imposition of 1% excise duty on jewellery (other than plain Silver jewellery) by the Government of India in Union Budget 2016-17 is not in the interest of the industry. GJEPC Chairman has already approached the Government to initiate meetings with the Finance Minister and Officials of the Finance Ministry and also the Commerce Minister & Commerce Ministry to persuade them to rollback their decision of imposition of excise duty on jewellery.

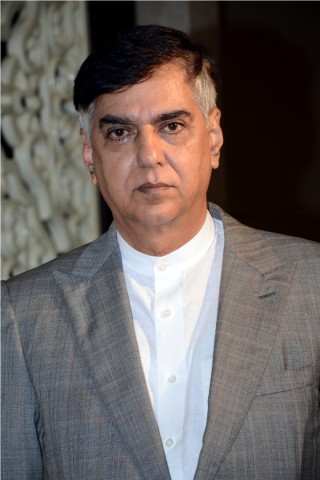

Mr. Praveenshankar Pandya, Chairman, GJEPC, said, “For 30 to 40 years, there was no excise on jewellery due to the small scale nature of manufacturing and sale of goods and the unique way the industry does its business. Also the industry also imports all its gold from outside after paying Customs duty. Hence, the Council is of the opinion that it needs to be withdrawn by the Govt. forthwith.”

“Though we morally support the stand taken by GJF and other industry associations, we do not want to go on strike as a protest against this announcement as we believe in engaging with the Govt. with constructive dialogue to persuade them to repeal the same,” Mr. Pandya added.

Gem & Jewellery Industry had made several representations to the Government to facilitate Ease of Doing Business in the Sector. In India, jewellery is largely produced by the SMEs and they are not equipped to follow the rigid compliance of excise norms. The imposition of excise would severely impact jewellery production in India resulting in loss of employment to the uneducated but skilled jewellery workers.

“We are distressed to find in the case of the gems & jewellery sector, no specific attention has been paid to address ease of doing business considering that exports of gems & jewellery account for a major share in the world market. We expected that the Government would announce measures to facilitate the export-oriented industries and create an environment of ease of doing business. We find that our existing concerns have not been addressed in this Budget,” Mr. Pandya added.

In the past, successive Governments have considered this and not levied excise on jewellery. The Council strongly urged the Hon. Finance Minister to reconsider the withdrawal of levy of excise on jewellery products. GJEPC will continue to engage with the government on key issues and challenges faced by the Industry.

About GJEPC

The Gem & Jewellery Export Promotion Council (GJEPC) was set up by the Ministry of Commerce and industry, Government of India (GoI) in 1966. It was one of several Export Promotion Councils (EPCs) launched by the Indian Government, to boost the country’s export thrust, when India’s post-Independence economy began making forays in the international markets. Since 1998, the GJEPC has been granted autonomous status. The GJEPC is the apex body of the gems & jewellery industry and today it represents over 6,000 exporters in the sector. With headquarters in Mumbai, the GJEPC has Regional Offices in New Delhi, Kolkata, Chennai, Surat and Jaipur, all of which are major centres for the industry. It thus has a wide reach and is able to have a closer interaction with members to serve them in a direct and more meaningful manner. Over the past decades, the GJEPC has emerged as one of the most active EPCs, and has continuously strived to both expand its reach and depth in its promotional activities as well as widen and increase services to its members.