2nd Best Year Ever For Absorption, Lowest Vacancy In 5 Years

2nd Best Year Ever For Absorption, Lowest Vacancy In 5 Years

Ramesh Nair, COO – Business & International Director, JLL India

Given the policy paralysis witnessed during the last two financial year (FY2012-13 and FY2013-14), GDP growth was recorded below 5.0% y/y during both years. Overcapacity in the critical mining and manufacturing sectors reduced the crucial supplies needed by various industries. As a result, a deadly combination of high inflation and falling consumption eventually stunted growth until early 2014. However, since the last two quarters, things have turned around.

The new government has done its homework well, and is targeting reforms at the right places. Real estate, mining, manufacturing and infrastructure seems to be the focus areas for improvements, also indirectly triggering growth for a multitude of ancillary and/or supporting industries. With the renewed confidence, the Indian economy is operating at a speed where current year (Fy2014-15) growth is expected at not below 5.5% y/y. Simultaneously, inflation has ceased to pose challenges to growth, which is positive. All this led to the Indian office market having the 2nd best year ever (other than 2011) in terms of absorption and the lowest vacancy levels since late 2009.

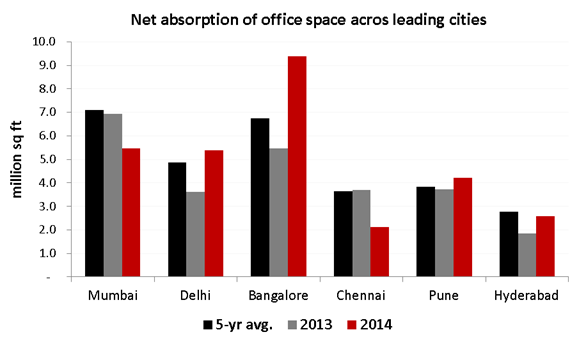

Demand: Close to 30 million sq.ft. of office space got absorbed in 2014, a 3.0 million jump in net absorption compared to the previous year. Cities which contributed the highest in terms of absorption were Bangalore and NCR-Delhi.

| Delhi | Mumbai | Bangalore | Chennai | Pune | Hyderabad | Kolkata | |

| Net absorption

(mn sq ft) |

5.38 | 5.46 | 9.39 | 2.12 | 4.21 | 2.59 | 0.70 |

| Contribution in India absorption (%) 2014 | 18% | 18% | 31% | 7% | 14% | 9% | 2% |

Bangalore witnessed a significant 72% year-on-year increase in net absorption in 2014, followed by NCR-Delhi (48%), Hyderabad (41%) and Pune (13%). Kolkata (-55%), Chennai (-43%) and Mumbai (-21%) witnessed a fall in net absorption from levels seen last year. A reason for the drop in absorption in Mumbai and Chennai was the lack of availability of suitable office space in the preferred micro-markets. The considerable growth of the IT-ITeS and e-commerce sectors is clearly visible in the growth of office space demand in the IT cities, whereas expansion was limited in sectors such as BFSI (which would have benefited Mumbai significantly). Mumbai also witnessed limited supply in comparison to other tier 1 cities such as Bangalore and NCR-Delhi.

In NCR, Gurgaon, NH8, MG Road and Noida city witnessed higher absorption in 2014 than in 2013. In Mumbai, the Eastern Suburbs and Thane-Navi Mumbai are the two sub-markets that witnessed higher absorption in 2014. In Bangalore, SBD and Whitefield witnessed higher absorption, while Chennai was among the few cities whose CBD recorded marginally higher absorption compared to 2013. Chennai’s PBD (peripheral business district) saw the biggest jump in take-up, while all other sub-markets it was relatively lower.

Pune is among the two cities (besides Kolkata) where CBD, along with SBD, witnessed a respectable jump in absorption compared to that of 2013. The city’s suburbs witnessed a lower absorption from last year. Hyderabad saw Hi-tech City and Gachibowli recording a higher absorption than last year. Absorption in other sub-markets was relatively lower, particularly in the CBD. Kolkata saw CBD absorption growing by more than 4x during 2014 when compared to 2013.

Pune is among the two cities (besides Kolkata) where CBD, along with SBD, witnessed a respectable jump in absorption compared to that of 2013. The city’s suburbs witnessed a lower absorption from last year. Hyderabad saw Hi-tech City and Gachibowli recording a higher absorption than last year. Absorption in other sub-markets was relatively lower, particularly in the CBD. Kolkata saw CBD absorption growing by more than 4x during 2014 when compared to 2013.

Sectors that contributed the highest in terms of leasing were IT-ITeS (35%), BFSI (17%), Manufacturing (13%), and Consulting business (6%). The improved economic outlook in the US, strengthening domestic capital markets and the government’s bold efforts to boost manufacturing sectors among the reasons why these sectors outperformed the others in terms of leasing.

US companies (44%) continued to retain the dominant in share of office space leasing in India in 2014, although its share has decreased by 4% points from the previous year. Domestic companies have increased their share to 33% from 31% the previous year. Despite economic concerns in European Union, the region increased its contribution to leasing by 2% in 2014 to 16%.

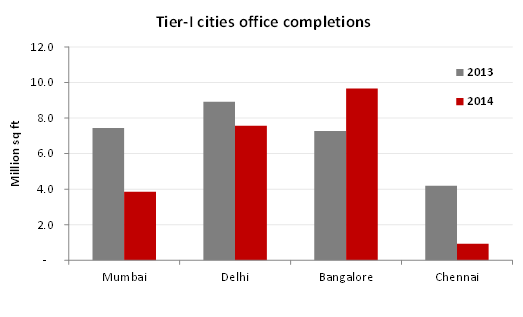

Supply: Total stock of Grade A office space across major Indian cities grew by 8.0% in 2014 over the previous year, with an additional supply of slightly below 30 million sq ft. Bangalore saw the biggest addition in office supply in absolute area terms, followed by NCR-Delhi. Mumbai, Pune and Hyderabad witnessed only moderate increases in supply. Chennai and Kolkata added very little supply to the overall basket during the year.

Supply: Total stock of Grade A office space across major Indian cities grew by 8.0% in 2014 over the previous year, with an additional supply of slightly below 30 million sq ft. Bangalore saw the biggest addition in office supply in absolute area terms, followed by NCR-Delhi. Mumbai, Pune and Hyderabad witnessed only moderate increases in supply. Chennai and Kolkata added very little supply to the overall basket during the year.

Vacancy: Pan-India office space vacancy dropped from 18.5% as of end-2013 to 16.9% as of end-2014. Mumbai, Chennai and Pune were responsible for this steep fall in vacancy during the year. While limited supply was helpful in reducing vacancy in Mumbai and Chennai, Pune benefited from both moderate supply and healthy growth in absorption. Despite a significant rise in supply in Bangalore, a healthier absorption resulted in reduced vacancy. The current vacancy levels in Mumbai is the lowest seen over the last 36 months.

| Delhi | Mumbai | Bangalore | Chennai | Pune | Hyderabad | Kolkata | |

| Vacancy (%) | 27.8% | 20.4% | 8.2% | 19.1% | 5.5% | 10.1% | 23.9% |

Rental: The markets which saw the most rental increase were Pune, Bangalore and Kolkata, with rental increases of 8.6%, 5.2% and 4.2% respectively. The rentals in the other markets remained stable.

Yield: Office yields remain unchanged from last year at 9.6% pan-India. The story remains the same across all major markets.

Outlook: With recovery definitely underway, many micro-markets across the country are expected to become landlord favouring. The actual vibrancy on ground is felt even more since GLV is higher than the net absorption by 15- 20%. With a healthy space demand list on hand from various corporates, it is going to be hard for corporates to find the right assets at the right location in 2015. The increase in corporate profitability, corporate confidence and economic growth will continue to result in headcount growth and expansionary leasing activity across most markets in 2015.

While challenges still exist, the forecasts for 2015 and 2016 projects considerable increase in office take-up when compared to 2012 and 2013. We expect only 22 million sq.ft. of office space to be ready at the right locations against the demand forecast of 30-32 million sq.ft. in 2015. Therefore, rental and capital values will continue to grow. Investment volumes are expected to go up in 2015, driven by low risk cross-border capital. Overall, the investment market will do better in 2015, with a substantial weight of capital targeting office real estate (especially Grade A and trophy assets). Strong investor demand for prime office assets, drop in interest rates and the lack of new supply of core investment options in the primary markets will result in yield compression.