Demonetization effect: Exuberance in November, Dismay in December

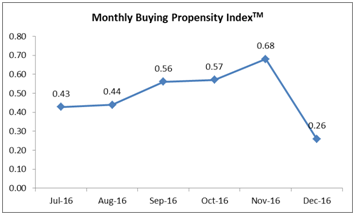

India, January, 2017: India’s Buying Propensity IndexTM (BPI) in December 2016 stood at 0.26, (measured on a scale between +1 to -1), down 0.42 BPI points from November (0.68). The period of November and December has been characterized by just a single event — the demonetization of high-powered currency notes. The Buying Propensity Index is a result of a primary research across 3,000 consumer-influencers across the 8 Tier –I cities in India conducted every quarter.

Chandramouli, CEO, TRA Research, elaborating on the BPI said, “The country’s buying sentiment was consistently recovering since July 2016, but Narendra Modi’s surprise demonetization announcement was the biggest factor causing unnatural fluctuations in the buying sentiment of the country as reflected by the Index. The November 2016 BPI had shown a rise of 19% stemming from the initial euphoria of long term positive connotations of the announcement.”

Chandramouli, CEO, TRA Research, elaborating on the BPI said, “The country’s buying sentiment was consistently recovering since July 2016, but Narendra Modi’s surprise demonetization announcement was the biggest factor causing unnatural fluctuations in the buying sentiment of the country as reflected by the Index. The November 2016 BPI had shown a rise of 19% stemming from the initial euphoria of long term positive connotations of the announcement.”

Chandramouli further added that the December fall was when the pain of demonetization began to be felt more severely after the first salary cycle post-demonetization  announcement in December, and the impact of the enduring business and personal hardships was felt by citizens. The buying sentiment in December seems to have fallen precipitously to the lowest in 9 months.

announcement in December, and the impact of the enduring business and personal hardships was felt by citizens. The buying sentiment in December seems to have fallen precipitously to the lowest in 9 months.

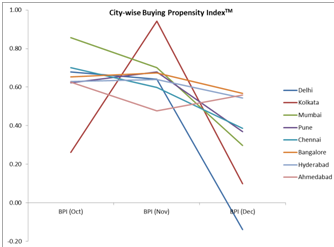

Considering the 8 cities studies for the BPI, Delhi was most severely impacted with a month-on-month fall of 122% in citizens ’keenness-to-buy, registering a negative sentiment in December at -0.14. This was followed by Kolkata with a BPI fall of 90%. The three cities which showed a medium fall in BPI were Mumbai (-58%), Pune (-46%) and Chennai (-35%). The cities which had a lower negative impact of demonetization on BPI were Bangalore (-16%) and Hyderabad (-15%). Ahmedabad was totally contrary to the BPI of the other cities, falling from a high 0.63 in October to 0.46 in November.

| Tier I City | BPI (Oct) | BPI (Nov) | BPI (Dec) | % change from Nov to Dec |

| Delhi | 0.68 | 0.64 | -0.14 | -122% |

| Kolkata | 0.26 | 0.94 | 0.10 | -90% |

| Mumbai | 0.86 | 0.70 | 0.30 | -58% |

| Pune | 0.62 | 0.68 | 0.37 | -46% |

| Chennai | 0.70 | 0.60 | 0.39 | -35% |

| Bangalore | 0.65 | 0.67 | 0.57 | -16% |

| Hyderabad | 0.63 | 0.64 | 0.54 | -15% |

| Ahmedabad | 0.63 | 0.48 | 0.56 | +17% |

About Buying Propensity IndexTM

The Buying Propensity Index (BPI) is a measure of the existing buying sentiment or ‘keenness to buy’ of India. The current Index represents the months of October, November and December 2016. The Buying Propensity indicator is a detailed analysis of three factors: the Transactional and Aspirational Buying Sentiment of the Indian consumer along with the Environmental Buying sentiment of the country. The BPI value can range between -1 and 1 ranging from a completely Negative Sentiment to a fully Positive Sentiment.

About TRA Research (www.trustadvisory.info)

About TRA Research (www.trustadvisory.info)

TRA Research, a Comniscient Group company, is a Data Insights and Brand Intelligence company dedicated to understand and analyze stakeholder behavior. TRA Research’s Buying Propensity Index is a syndicated study which surveys 3,000 consumer-influencers across 8 cities in India conducted every quarter. Buying Propensity measures the Transactional, Aspirational and Environment sentiments towards making buying decisions and is a direct measure of propensity to buy. TRA Research also publishes The Brand Trust ReportTM and India’s Most Attractive BrandsTM.