There is blood on the streets. Metaphorical and real to a large extent. Markets are volatile and uncertainty is the order of the day. Fears of a double-dip recession is high amongst the people and fear mongering has become a viable business.

There is blood on the streets. Metaphorical and real to a large extent. Markets are volatile and uncertainty is the order of the day. Fears of a double-dip recession is high amongst the people and fear mongering has become a viable business.

President Obama’s re-election is a sign of perhaps calmer waters ahead, but fears of the ‘fiscal cliff’ are looming large on people’s minds. The fear of austerity measures and higher taxes are very real fears. Superstorm Sandy’s remnants have also made the economic situation that much worse. Stock markets are still treading cautiously despite unexpectedly better economic reports.

Europe continues to sail in choppy waters thanks to the severe economic situation in Greece and Spain. Germany has also been braving rough weather of late. There is still debate over the size of Greece’s bailout package and whether the next tranche of money will arrive in time. Economic activity in the eurozone as a whole has declined, though steps are being taken to prevent the imminent economic explosion.

China’s announcement of a $156 billion investment in the country’s infrastructure does represent a brighter outlook, and this news has buoyed up the price of iron ore, copper and aluminum, core industries, on the basis of which economies of countries rise and fall.

India also has not been immune to the weathers of change abroad. While the economy has fared better than many others in the developed western world, growth has dropped. The rupee may have picked up on the back of the latest economic stimuli applied to the Indian economy, but it is still weaker when compared to data as recent as a year ago. The government of India may have finally shrugged off the policy paralysis that was present over almost the entire duration of UPA II till date, but good economics don’t always make popular electoral policies. While industrialists heave a sigh of relief, politicians are going up in arms to stop all the reform policies, because most politicians in India are mostly concerned about votebank politics. So, the longevity of our current government is in question with the opposition aggressively pushing for early polls.

Needless to say, despite the very bleak present, steps are being taken globally to combat the scenario and to rectify errors and boost the economy. But it is anybody’s guess as to how long it will take before we are indubitably on the road to recovery. People are looking to diversify their asset portfolio in the hope of maximizing their returns in this long continuing bear market.

There have traditionally been three main asset classes where people have invested their money – stocks, real estate and jewelry. A fourth has been added – art.

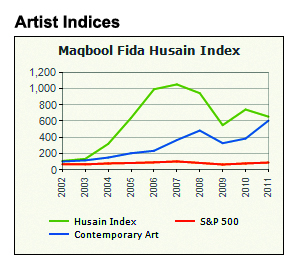

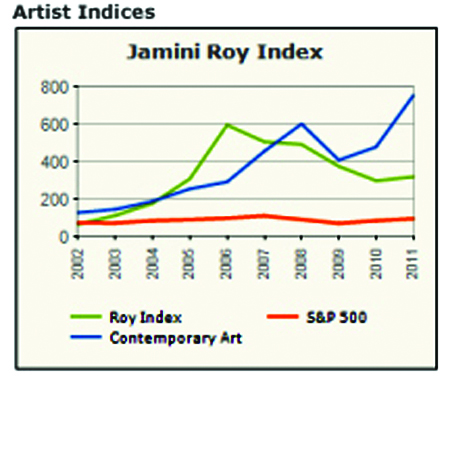

Art is ideally a long term investment, as it does not have the easy liquidity of stocks or jewelry, but as an asset class, it has always consistently outperformed all three in both bear and bull markets. Two graphs from artnet.com show the graphs of two famous and prominent Indian artists – Jamini Roy and Maqbool Fida Husain. Jamini Roy is considered by many to be the first true modern painter that India has produced and Husain, unarguably the most famous. The graphs show the ups and down of these artists against the Indian contemporary art scene as a whole and the S&P 500, the 500 most actively traded shares in the American economy as decided by Standard and Poor. These clearly show, that even the lowest low-points of these artists have still fared better than the best prices of the S&P 500, not just across 1 or 2 years but the last decade.

While the Indian art market has dipped recently in the current global economic scenario, it is still outperforming shares and real estate. Additionally, just like with shares, a bear market is the right time to buy, because prices have relatively dropped and one has the opportunity to snap up gems at lower prices. Again, just like with shares, people make a profit by selling it in the bull market when prices are at an all time high thereby making good on the investment.

Plus, art has the added advantage of being an asset that one can physically admire at all times. One can hang it on the wall and enjoy its beauty for years to come. Art also confers a certain special social standing on the buyer, people can appreciate and admire the buyer’s taste and undeniable wealth. People don’t just buy art as an investment alone, but also because a beautiful work of art has the power to make our lives more beautiful and bearable. Real collectors often sit for hours before a loved artwork, reveling in its beauty. That, is also what often sets apart art from other asset classes.

(Arkamitra Roy has been working as an art researcher for the last 7 years. She looks into buying and selling trends, analyzing auction results and advises on what to buy to secure investments. She is also an avid photographer.)