Subpar VC investment activity for solar four quarters in a row

KOLKATA – July 11, 2013 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and mergers and acquisitions (M&A) activity for the solar sector during the second quarter of 2013.

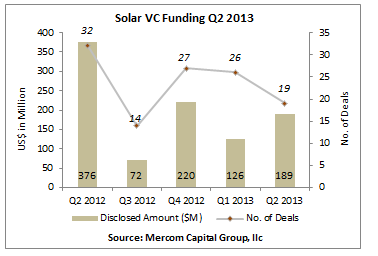

Solar venture capital (VC) investments increased to $189 million in 19 deals in Q2 2013 compared to $126 million in 26 deals in the previous quarter. Solar downstream companies received most of the funding with $128 million.

compared to $126 million in 26 deals in the previous quarter. Solar downstream companies received most of the funding with $128 million.

Total corporate funding in the solar sector including, VC funding, debt financing and other types of funding raised by public companies through sale of shares total $915 million.

“With solar technology companies struggling, investments have been going to downstream companies,” commented Raj Prabhu, CEO of Mercom Capital Group. “That said, investments into solar technology companies haven’t completely dried up. Small venture rounds are still going to several niche technology companies instead of the larger deals that were typical for thin film, CSP and CPV companies.”

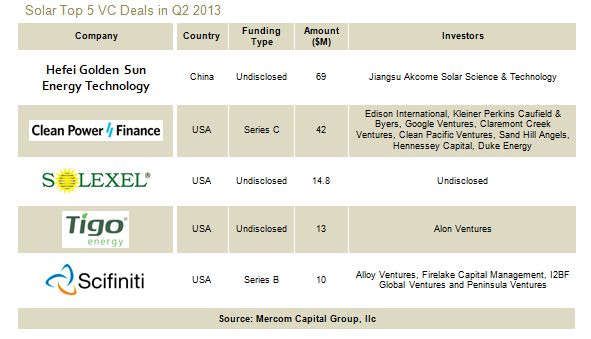

The largest VC deals in Q2 2013 included the approximately $69 million raised by Chinese solar developer Hefei Golden Sun Energy Technology from existing investor Jiangsu Akcome Solar Science & Technology. Clean Power Finance, a provider of third-party financing for distributed PV projects through its software platform, raised $42 million from Edison International, Kleiner Perkins Caufield & Byers, Google Ventures, Claremont Creek Ventures, Clean Pacific Ventures, Sand Hill Angels, Hennessey Capital, Duke Energy, and two other investors. Solexel, a developer of high-efficiency crystalline silicon solar cells and modules, raised $14.8 million, followed by Tigo Energy, a developer of smart modules and optimizers for PV systems, which raised $13 million from Alon Ventures. Scifiniti, a crystalline silicon technology company focused on delivering a low cost drop-in replacement to photovoltaic silicon wafers, raised $10 million from Alloy Ventures, Firelake Capital Management, I2BF Global Ventures and Peninsula Ventures. There were 27 active VC investors in the sector this quarter.

Solar third party finance companies raised a record $1.33 billion in disclosed residential and commercial solar project funds this quarter, the strongest quarter ever for solar lease funds, with the total amount raised in the first six months almost equivalent to all of the solar lease funds raised last year.

Solar M&A activity in Q2 2013 amounted to $1.27 billion in 18 transactions. Themes emerging out of this quarter’s M&A activity included: consolidation in the inverter market, strategic acquisitions, and acquisitions of distressed assets/companies.

emerging out of this quarter’s M&A activity included: consolidation in the inverter market, strategic acquisitions, and acquisitions of distressed assets/companies.

The largest disclosed M&A transaction by dollar amount in Q2 2013 was the Swiss power and automation technology group ABB’s acquisition of Power-One, a provider of renewable energy and energy-efficient power conversion and power management solutions, for approximately $1 billion. Enel Energia, a power distribution company, also reached an agreement to acquire Enel.si, a manufacturer of photovoltaic, solar thermal and mini-wind systems from Enel Green Power S.p.A., a renewable power generation company, for approximately $123 million. Advanced Energy Industries, a provider of power and control technologies for thin-film manufacturing and solar-power generation, acquired REFUsol Holding, a provider of three-phase string solar PV inverters for commercial applications, for $77 million. Sino-American Silicon Products, a manufacturer of solar silicon wafers, bought Sinosolar Corporation, a producer of solar wafers and solar cells, for $27 million. LDK Solar, a vertically-integrated manufacturer of photovoltaic products, sold its interest in LDK Solar High-Tech (Hefei) Co. to Hefei High Tech Industrial Development Social Service Corporation, an affiliate of the Hefei City Government, for approximately $19 million.

Announced large-scale project funding in Q2 2013 came in at $2.94 billion, up from $1.77 billion last quarter. Solar Star Funding, the wholly owned subsidiary of Warren Buffet’s MidAmerican Energy, completed a $1 billion bond offering this quarter, the largest solar bond financing deal to date.

There were more than 670 MW of disclosed projects that changed hands in the second quarter of 2013. The Top 5 disclosed acquisitions by project size ranged from 30 MW to 150 MW. The largest transaction was First Solar’s acquisition of the 150 MW Solar Gen 2 Project in California from an affiliate of the Goldman Sachs Group, Energy Power Partner and a third undisclosed equity partner, followed by First Solar’s sale of its 139 MW Campo Verde Solar Project to Southern Power and Turner Renewable Energy. First Solar also acquired the 60 MW North Star Solar Project from NorthLight Power. The fourth largest transaction by project size was BluEarth Renewables’ acquisition of four photovoltaic projects in Canada from Canadian Solar Solutions totaling 53.9 MW. The fifth largest acquisition was Armstrong South East Asia Clean Energy Fund’s acquisition of a 60 percent stake in Symbior Solar Siam’s Central and Northeast Solar Projects totaling 30 MW.

Loans, credit facilities and other types of debt agreements from Chinese banks now stand at about $53 billion.

To learn more about the report, visit: http://store.mercom.mercomcapital.com/products-page/solar-reports/solar-q2-2013-funding-and-ma-report/

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and consulting firm focused exclusively on clean energy and financial communications. Mercom’s consulting division advises cleantech companies on strategies for strategic decision making and new market entry and provides custom market research. Mercom’s consulting division also delivers highly respected industry market intelligence reports covering Solar Energy, Wind Energy and Smart Grid. Our reports provide timely industry happenings and ahead-of-the-curve analysis specifically for C-level decision making. Mercom’s communications division helps clean energy companies and financial institutions build powerful relationships with media, analysts, government decision makers, local communities and strategic partners. For more information about Mercom Capital Group, visit: http://www.mercomcapital.com. To get a copy of Mercom’s popular market intelligence reports, visit: http://mercomcapital.com/market_intelligence.php.