MicroMoney, the market first blockchain credit bureau and a social lending services provider, announced a new franchise partnership with Prosperous Capital & Credit Limited, a leading microfinancing organization in Sri-Lanka. In under a month, the company has opened a new office in Colombo to provide new financial opportunities to the unbanked and underbanked population in the region. This latest expansion brings MicroMoney’s count of Southeast Asian operations to five countries: Cambodia, Myanmar, Thailand, Indonesia, and Sri-Lanka now.

The company behind MicroMoney’s Sri Lankan franchise is Prosperous Capital & Credit Limited, an award winning, sustainably driven Micro and SME finance organization. In 2015 they won the best new Micro and SME Provider Award from ‘The Global Banking and Finance Review’, and again in the same category from ‘The International Finance Magazine’. The company also boasts to its name the first microfinance organization in Sri Lanka to have been given full ISO certification, and as a member of the United Nations Global Compact Program actively works to support its principles.

The decision to move into the Sri Lankan market may prove to be one of lasting social benefit. Despite being a bank-based economy, the country exhibited low banking penetration compared to regional counterparts. According to the annual report of Central bank of Sri Lanka, the penetration of the banking sector, which is measured by M2 (Broad Money) to GDP ratio stands at 40%. Well below regional peers such as India (85%), Singapore (137%), Thailand (141%), and Malaysia (157%).

They also found that Sri Lanka has recorded an average of 7.5% to 8.0% in savings to investments over the past 5 years, which is considered to be a significant gap compared to regional counterparts such as India, Thailand, Vietnam, and the Philippines. This creates a substantial opportunity for financial companies such as MicroMoney to build a culture of savings amongst rural low-income earners through uplifting their livelihood.

Finally, Sri Lanka is ranked relatively poorly in terms of sophistication in the banking sector. In addition, it is ranked low for country’s intensity for formal finance. In fact, last year the World Bank found that only 17.9% of adults reported having taken a loan from a financial institution. With more than three quarters of the adult population unable to get a loan, many have turned to loan sharks and other dubious lenders. Such lenders take advantage of vulnerable members of society, often with disastrous consequences for the borrowers and their families. It’s a social problem crying out for a solution – social lending.

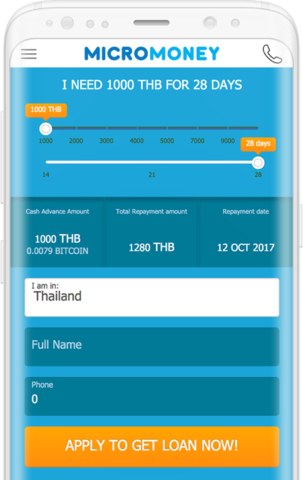

MicroMoney plans to help using their unique approach, which leverages the remittance technology of Everex and means all clients will have a credit score intelligently assessed in less than 15 minutes. All they have to do is install the MicroMoney app onto their smartphones and their data is analyzed on a neural network. Using over ten thousand correlations in total, ranging from social media activity to musical preferences, the network is able to calculate the odds of a loan amount being repaid with 95% accuracy. Once approved, customers can apply for a small loan of $20. As the customer’s credit history improves, so too does the amount they can loan.

All credit scores are stored in the blockchain, and with the client’s consent, can be shared with banks and other financial organizations just as with usual credit bureaus. By making this information accessible to banks and other interested parties, MicroMoney opens previously unseen clients to the global financial economy.

Having already established successful businesses in Asia, MicroMoney is on track to expand globally via a franchise model. By combining local knowledge with MicroMoney’s proven experience and success, co-founder Anton Dzyatkovsky is understandably optimistic.

“We have found a win-win strategy to build our worldwide presence and leverage our technical and business excellence. With MicroMoney now available to Sri-Lankan citizens, we will drive global inclusion for all people who were previously lacking access to the financial system. They can take advantage of short-term loans to solve immediate challenges and plan ahead when their credit score becomes a door to more opportunities such as travels, entrepreneurship, and better quality of life”, explained Anton Dzyatkovsky. “Also, with our ‘blockchain-based credit bureau’ approach, we, on the other hand, open a vast database of new clients with arguably lowest acquisition costs. Making both parties enjoy benefits is the cornerstone of our business model”.

Prosperous Capital & Credit Limited’s managing director Mr. Madhawa Edussuriya was equally as enthusiastic at the prospect of doing business in Sri Lanka. “There is huge potential for what we are doing. This potential is now being recognized abroad, and we have already attracted two Japanese hedge fund investors,” explained Mr. Edussuriya. “As we work hard to give loans to tens of thousands of customers per year, MicroMoney has committed to assisting us with client inquiries at their multilingual call center in Bangkok. It’s a partnership built for success.”

About MicroMoney

Founded in 2015, MicroMoney International (micromoney.io) is a global fintech company offering financial services for the unbanked in the emerging markets, and access to the unbanked audience for banks, trade, and financial organizations. MicroMoney is a fast-growing company valued at $1.85 million, with over 85 employees in six international locations.

MicroMoney makes lending decisions using a proprietary, A.I. algorithms and neural networks-based mobile scoring system. MicroMoney’s lending process doesn’t require any collateral or paper-based documentation. MicroMoney collects customers’ opt-in mobile phone data to establish potential borrowers’ credit score. MicroMoney uses the score to generate credit profiles, stored with MicroMoney Blockchain Credit Bureau, which in turn shares this data with financial institutions worldwide. For more information or to register your exchange please visit: https://micromoney.io/