Record $1.93 Billion Raised by Residential and Commercial Solar Funds

Record $1.93 Billion Raised by Residential and Commercial Solar Funds

KOLKATA – July 15, 2015 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and merger and acquisition (M&A) activity for the solar sector in the second quarter of 2015.

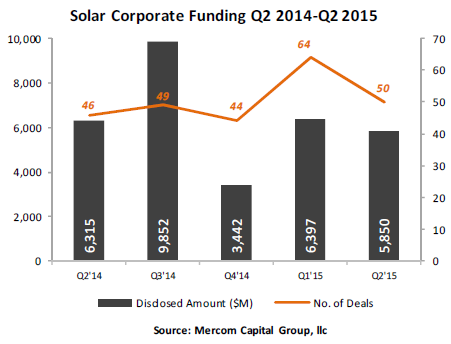

Total global corporate funding in the solar sector, including venture capital/private equity (VC), debt financing, and public market financing raised by public companies, decreased to $5.9 billion, compared to $6.4 billion in Q1 2015.

Raj Prabhu, CEO of Mercom Capital Group, commented, “Overall corporate funding was down slightly this quarter. Yieldcos had a significant impact on the financial activity in the sector and raised $1.6 billion in public markets, about $800 million in debt, and accounted for almost a third of all large-scale project acquisitions. Residential and commercial solar funds continue to attract record funding as the ITC expiration deadline approaches.”

VC funding dipped to $142 million in 24 deals, compared to $195 million in 27 deals in Q1 2015. Solar downstream companies continued to attract most of the VC funding with $60 million in 13 deals.

Among the Top 5 VC deals in Q2 2015, the largest was the $40 million raised by Applied Solar Technologies, an off-grid solar energy service provider based in India, from Future Fund, Bessemer Venture Partners, Capricorn Investment Group and International Finance Corporation. Solexel, a manufacturer of crystalline-silicon solar cells and modules, raised $29.5 million. Solantro Semiconductor, a developer of chipsets and reference designs for module integrated electronics within distributed solar PV solutions, raised $11 million from Black Coral Capital, Business Development Bank of Canada, Presidio Ventures, Clean Energy Venture Group, Export Development Canada and Inerjys Ventures. Flisom, a Swiss developer of manufacturing technologies for the production of flexible solar modules based on CIGS thin-film technology, raised $10.7 million from the Tata Group. Persimmon Technologies, a technology company that develops, manufactures and distributes robotics and automation systems used in semiconductor, solar, LED, and flat panel display equipment, raised $8.9 million.

A total of 28 VCs invested in Q2 2015, with Clean Energy Venture Group participating in two deals.

Public market financing was a record $2.3 billion this quarter compared to $1.3 billion in Q1 2015. The largest deals this quarter (excluding IPOs) were the $670 million raised by Abengoa Yield, $408 million raised by Risen Energy, a Chinese solar PV manufacturer, and the $335 million raised by SunEdison, through its TerraForm Global Yieldco. There was one IPO this quarter: 8point3 Energy Partners, a yieldco company formed by First Solar and SunPower to own, operate and acquire solar energy generation projects, raised $420 million and listed on NASDAQ Global Select Market.

Debt financing fell this quarter to $3.4 billion, compared to $5 billion in Q1 2015. The top deal was the $1.3 billion loan secured by GCL New Energy, a Chinese solar project developer and investor, from China Merchants Bank, Nanjing Branch.

Announced large-scale project funding came to $1.9 billion in 26 deals, compared to $2.5 billion in 29 deals in Q1 2015. The Top 5 large-scale project funding deals included the $355 million raised by GE Energy Financial Services in a partnership with Pacifico Energy, for the development of a 96.2 MW solar PV project in Hosoe, Kyushi Island, Miyazaki prefecture, Japan. GE Energy Financial Services brought in $62.7 million in equity and secured a $292 million loan from a syndicate of 12 Japanese financial institutions led by The Bank of Tokyo Mitsubishi UFJ. sPower, an independent power producer, received a $168.5 million loan from KeyBank National Association, OneWest Bank and Zions Bank for 25 solar assets, totaling 144 MW in three separate portfolios. Low Carbon, a renewable energy developer, operator and investor, secured $163.5 million in refinancing from Macquarie Infrastructure Debt Investment Solutions for part of its existing portfolio of twelve operational solar projects with a cumulative capacity of 99.2 MW in the United Kingdom. Kong Sun Holdings Company received a $163 million finance lease credit line from Jiangsu Solarbao Leasing, a wholly-owned subsidiary of SPI Solar, for its PV projects in China. ONEE, Morocco’s state-owned electricity and water company, received a $149 million loan for three solar PV projects with a total capacity of 75 MW. The projects are co-financed by a $125 million World Bank loan and a $23.95 million loan from the Clean Technology Fund.

Residential and commercial solar funds raised $1.93 billion in five deals, similar to the $1.92 billion raised in 10 deals last quarter, and the highest quarter to date. Of this total, $775 million went to three loan funds and $1.2 billion went to two third-party lease or PPA funds. SolarCity announced $1.5 billion in two separate deals.

There were 17 corporate M&A transactions in the solar sector this quarter, compared to 29 transactions in Q1 2015. Solar downstream companies accounted for 10 of these M&A transactions.

The largest disclosed M&A transaction was the acquisition of RBI Solar, Rough Brothers Manufacturing, and affiliates (collectively RBI) for $130 million by Gibraltar Industries. RBI Solar is engaged in the design, engineering, manufacturing and installation of solar mounting systems for commercial and utility-scale solar projects.

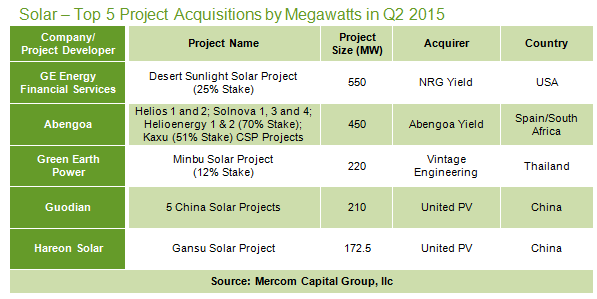

There were 66 large-scale solar project acquisitions totaling $2.9 billion with about 3.5 GW changing hands, compared to 44 transactions in Q1 2015 for $953 million. The top disclosed project acquisition by dollar amount was the $669 million acquisition of four solar projects totaling 450 MW by Abengoa Yield, a dividend growth oriented yieldco which will own, manage and acquire renewable energy, conventional power and electric transmission lines and other contracted revenue-generating assets, from Abengoa, a Spanish multinational corporation and a solar project developer. NRG Yield, a developer of renewable and conventional energy and thermal infrastructure projects and a yieldco subsidiary of NRG Energy, acquired a 25 percent interest in the 550 MW Desert Sunlight solar project in Riverside, California from GE Energy Financial Services for $285 million. United Photovoltaics Group, a Chinese investor and operator of PV projects, acquired 17 solar projects in China from Hareon Solar Technology, a vertically-integrated solar PV manufacturer this quarter. The top acquisitions included the 172.5 MW Gansu solar project for $268.6 million, the 115 MW Hebei solar project for $181 million, and the 100 MW Taiyuan solar project for $163 million.

Mercom also tracked 209 new large-scale project announcements in various stages of development worldwide in Q2 2015 representing 10.4 GW.

To learn more about the report, visit: http://store.mercom.mercomcapital.com/product/q2-2015-solar-funding-and-ma-report/

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and consulting firm focused exclusively on clean energy and financial communications. Mercom’s consulting division advises cleantech companies on new market entry, custom market intelligence and overall strategic decision making. Mercom’s consulting division also delivers highly respected industry market intelligence reports covering Solar Energy, Wind Energy and Smart Grid. Our reports provide timely industry happenings and ahead-of-the-curve analysis specifically for C-level decision making. Mercom’s communications division helps clean energy companies and financial institutions build powerful relationships with media, analysts, government decision makers, local communities and strategic partners. For more information about Mercom Capital Group, visit: http://www.mercomcapital.com. To get a copy of Mercom’s popular market intelligence reports, visit: http://mercomcapital.com/market_intelligence.php.

Notable Indian Transactions in Q2 2015:

VC Funding:

- Applied Solar Technologies, a Delhi-based off-grid solar energy service provider raised $40 million from Future Fund, the Australian government’s sovereign wealth fund, Bessemer Venture Partners, Capricorn Investment Group and International Finance Corporation.

- Ecozen Solutions, a renewable energy-focused company that provides solar-powered micro cold storage system and solar powered pumps, received about $1 millon in Series A funding from Omnivore Partners, for a minority stake.

- kWatt Solutions, a Mumbai-based company that provides customized comprehensive solar energy solutions from design and engineering to installation and maintenance with in-house training for people in the solar industry, raised $500,000 in funding from a real estate house in Indore.

- SunTerrace Energy, a provider of integrated solar energy solutions raised an undisclosed amount of seed funding from US-based Sunergy Investors.

M&A:

- Surana Telecom and Power, a telecommunication and power company that also manufactures solar PV modules, was involved in four transactions this quarter. They acquired a 51 percent equity stake in two solar project development companies; Tejas India Solar and Arhyama Energy. In addition, Surana divested its 49 percent equity stake from the joint venture Radiant Alliance Limited, a solar PV module manufacturer/assembler in Bangladesh. Surana also has divested 49 percent equity share in its wholly-owned subsidiary Celestial Solar Solutions, a solar project developer, and sold them to NVR Infrastructure and Services, a solar project developer, for $39,147.

Project Acquisition:

- SunEdison, a solar energy services and technology provider, acquired 51 percent equity interest from its partner, an affiliate of Chint Solar (Zhejang), in the 23.1 MW solar project NSM 24 located in India.