Strong Corporate and Project M&A Activity Reported

KOLKATA – February 2, 2016 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and merger and acquisition (M&A) activity for the wind sector in 2015.

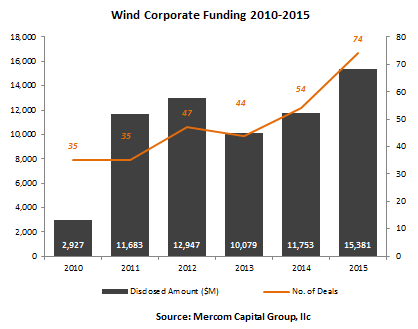

Total global corporate funding in the wind sector, including venture capital/private equity (VC/PE), debt financing and public market financing, raised by public companies shot up to a record $15.4 billion, compared to $11.8 billion in 2014.

and public market financing, raised by public companies shot up to a record $15.4 billion, compared to $11.8 billion in 2014.

Global VC investments rose to $520 million in 14 deals in 2015, compared to $311 million in 15 deals in 2014.

Wind downstream companies accounted for most of the VC funding with $505 million of the $520 million raised.

The top VC funded company in 2015 was ReNew Power Ventures, an independent power producer, which raised $265 million. Eren Renewable Energy, a renewable energy project developer, raised $114 million, followed by Apex Clean Energy, an independent renewable energy company, which secured $80 million in two separate deals, and UrbanWind, a wind project developer, raised $45 million.

Public market financing in the wind sector was down this year with $2.8 billion in 20 deals, compared to 16 deals for $3.7 billion in 2014. There were three IPOs in 2015, including two yieldcos, raising a total of $1.3 billion.

Public market financing in the wind sector was down this year with $2.8 billion in 20 deals, compared to 16 deals for $3.7 billion in 2014. There were three IPOs in 2015, including two yieldcos, raising a total of $1.3 billion.

Announced debt financing this year increased by more than 56 percent bringing in $12 billion in 40 deals, compared to 2014 with $7.7 billion in 23 deals.

Announced large-scale project funding deals in 2015 totaled $18.3 billion in 101 deals compared to $19.9 billion in 120 deals in 2014. A total of 113 investors participated in these deals. Top investors continued to be development banks including KfW IPEX-Bank, which funded 14 projects, Brazilian Development Bank with nine, Santander with seven and Overseas Private Investment Corporation, which funded five projects.

Wind corporate M&A activity in 2015 accounted for 48 transactions of which only 30 disclosed transaction amounts. In comparison, there were 28 transactions (12 disclosed) in 2014.

In comparison, there were 28 transactions (12 disclosed) in 2014.

Of the 48 M&A transactions, wind downstream companies accounted for 32 this year compared to 20 of the total 28 M&A transactions in 2014. The top three M&A transactions this year all involved wind downstream companies.

The top M&A transaction in 2015 was the acquisition of Pacific Hydro by China’s State Power Investment Corporation for $2 billion.

There were 154 wind project acquisitions in 2015 for nearly 30 GW compared to 2014 also with 154 transactions, for about 25 GW of wind projects. Investment funds once again led project acquisitions with 9 GW in 2015, followed by project developers with 8 GW, utilities with 7 GW and yieldcos with 5 GW of wind project acquisitions.

Of the 154 project acquisitions this year, 140 involved onshore wind projects compared to 136 that exchanged hands in 2014.

The largest disclosed project acquisition by dollar amount in 2015 was the $2 billion acquisition of 930 MW of wind projects from Invenergy Wind, a wind project developer, in the U.S. and Canada by TerraForm Power, a yieldco company of SunEdison.

Mercom also tracked 48.8 GW of announced large-scale onshore and offshore projects in 2015 in various stages of development globally that could be potential candidates for financing and M&A .

There were 647 companies and investors covered in this report. It is 121 pages in length, and contains 69 charts, graphs and tables.

To learn more about the report, visit: http://bit.ly/MercomWind2015

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and research and consulting firm focused on cleantech. Mercom delivers market intelligence and funding and M&A reports covering Wind, Smart Grid and Solar and advises companies on new market entry, custom market intelligence and strategic decision-making. Mercom’s communications division helps companies and financial institutions build powerful relationships with media, analysts, local communities, and strategic partners. About Mercom: http://www.mercomcapital.com. Mercom’s clean energy reports: http://store.mercom.mercomcapital.com/page/.

Notable Indian transactions in Q4 2015

VC Funding:

- ReNew Power Ventures, an independent power producer, raised $265 million from Abu Dhabi Investment Authority, Goldman Sachs and Global Environment Fund.

M&A:

- Sudhir Valia, a promoter of Fortune Financial Services (India), acquired the wind power assets of Jaiprakash Associates, an industrial conglomerate, for $27 million.

- Inox Wind Infrastructure Services, a wholly owned subsidiary of Inox Wind, acquired 100% of the equity shares of Sarayu Wind Power (Tallimadugula), a wind project developer, for an undisclosed sum.

Project M&A:

- Gujarat NRE Coke, an independent producer of met coke in India, sold 62 windmills situated in Gujarat, India, for a consideration of $33.46 million. The combined installed capacity of the windmills is 87.5 MW.