Vendors Realising The Importance Of Robust Offline Smartphone Distribution In Tier 2&3 Cities And Beyond: IDC India

Vendors Realising The Importance Of Robust Offline Smartphone Distribution In Tier 2&3 Cities And Beyond: IDC India

New Delhi, 2nd Sep 2016: According to International Data Corporation’s (IDC) Monthly City Level Smartphone tracker, the leading 30 cities of India registered growth of 10.2 percent quarter on quarter in Q2 2016 over Q1 2016. The demand from Tier 2&3 cities is outgrowing Tier 1 cities by clocking +12.9 percent growth vs 8.1 percent for the latter. As signs of saturation are beginning to appear in urban markets (esp. Tier 1), which is a major hub for online sales, vendors are looking to tap the consumer base in Tier 2&3 and rural areas by setting up offline distribution networks.

According to Upasana Joshi, Senior Market Analyst, IDC India, “We are seeing changes in the distribution strategies by many vendors with many popular online exclusive models being made available offline as well, such as Xiaomi Redmi Note3, Le Eco Le1s, Moto G Turbo Edition, etc. This is indicative of an evolving hybrid distribution structure – online plus offline, which will help these vendors bring their popular smartphone models into smaller towns & cities.”

Price discipline getting established between online and offline channels, has led to a resurgence in the importance of the brick and mortar stores. Market sustainability in the longer run will be driven by presence of a strong offline distribution channel.

“With aggressive marketing spends and channel expansion, China based vendors like Oppo & Vivo are gaining traction across all city Tiers. The channel is upbeat and excited with the sales schemes being offered by these vendors resulting in fast moving stocks” adds Joshi.

The China based vendors on the back of their quality products at affordable prices and wide availability have largely contributed to the growth of price segment $150-$200 & $200-$250 across top 30 cities contributing 28 percent in Tier 1 cities in Q2 2016 as compared to 19 percent in Q1 2016 and 24 percent in Tier 2&3 cities as compared to 17 percent in the previous quarter.

“Apart from Reliance Jio (Lyf), other Indian vendors were unable to hold on to their market share in Q2 2016. Similar was with global vendors except for Samsung which managed to sustain its market leadership position. This has led to a sharp increase in the market shares of China based vendors across all Tiers even with their mid segment ASPs (ranging from $150-$200) purely on the back of strong distribution channel, better channel schemes and huge promoter programmes as compared to the rest” says Varun Singh, Market Analyst, IDC India. “This is a clear indication that the offline channel cannot be wished away by vendors for operating long term in highly competitive Indian market” adds Singh.

Top Vendor Highlights:

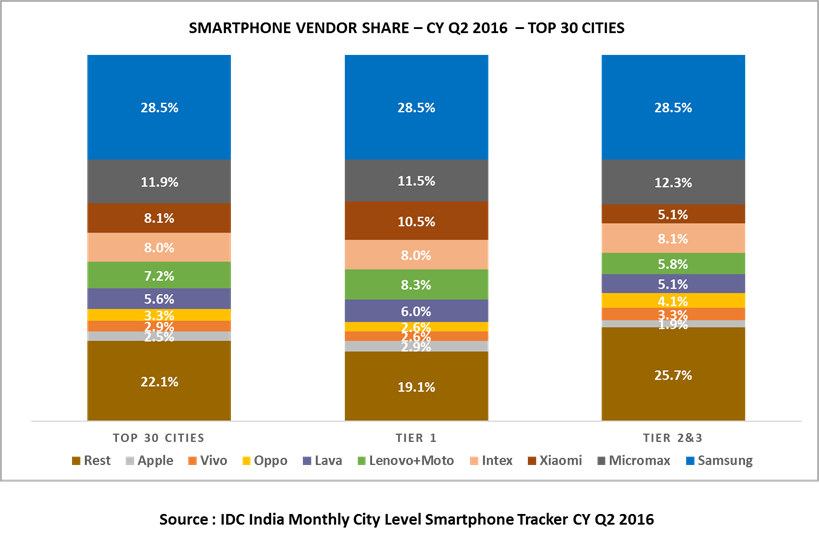

Samsung: continues to lead the smartphone market with 28.5 percent share, clocking 5.7 percent growth from the previous quarter. Alongside the newly launched J series (2016 versions), the J series range continue to drive the maximum volumes for Samsung.

Micromax: maintains second position in CY Q2 2016 with 11.9 percent share. It regained share in the less than $100 price segment to be at the top position on the back of newly launched Bolt & Canvas Spark series, but is facing stiff competition from Lyf “Flame series”.

Xiaomi: moved up to third position in CY Q2 2016 with 8.1 percent share on the back of its hit model Redmi Note 3. The model generated massive demand owing to its loaded feature specs at an affordable price.

Intex: retains fourth position with 8.0 percent share, but dropped in volume growth by 4.6 percent. It continues to command significant share in below $100 price segment; however, channel partners feel there is an immediate need for a refreshed high decibel visibility campaign to enhance further demand.

Lenovo (including Motorola): slipped to fifth position in CY Q2 2016 with 7.2 percent share. G4 Plus and Vibe K5 Plus launched in Q2 2016 is expected to generate demand in the coming months. Lenovo had also expanded its presence to retail counters which is yet to pick up volumes.

Oppo & Vivo: stand at 7th & 8th position with 3.3 percent share & 2.9 percent share respectively. With aggressive marketing spends, in store promotions and expansion of retail presence, both these Chinese vendors are successful in quick demand ramp up across Tiers. Their model line-up is majorly placed in $200 & above price segment giving stiff competition to the Global vendors in this segment.

Apple: in the above $300 price segment commands a share of 35.6 percent in CY Q2 2016, with majority sales driven from iPhone 5s and 6s models.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semi-annual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools. The IDC Tracker Charts app allows users to view data charts from the most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a subsidiary of IDG, the world’s leading technology media, research, and Events Company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.