KOLKATA – October 29, 2014 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and merger and acquisition (M&A) activity for the wind sector during the third quarter of 2014.

communications and consulting firm, released its report on funding and merger and acquisition (M&A) activity for the wind sector during the third quarter of 2014.

Total corporate funding in the wind sector dropped to $2.4 billion in Q3 2014, including VC funding, debt and public market financing, compared to $4 billion in Q2.

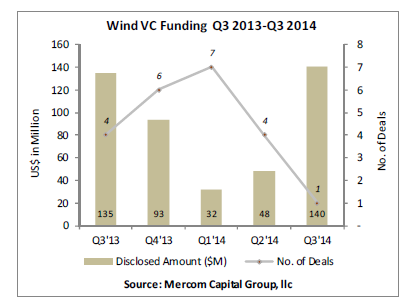

Wind venture capital (VC) funding came in at $140 million in one deal, compared to $48 million in four deals in Q2 2014. The only VC deal in Q3 was ReNew Power Ventures’ $140 million raise from Goldman Sachs Group, Asian Development Bank and GEF SACEF India.

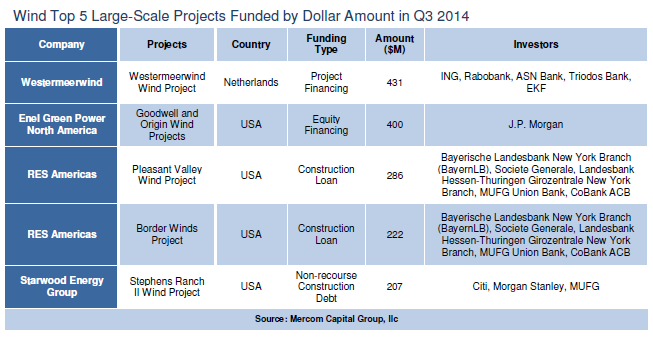

Announced large-scale project funding in Q3 2014 fell to $3 billion in 28 deals, compared to $6.3 billion in 38 deals in Q2 2014.

Mercom also tracked nearly 10.9 GW of new project announcements globally this quarter in various stages of development. Onshore projects accounted for 8 GW from 54 announced projects, while offshore projects totaled 2.9 GW from five announced projects.

There were six M&A transactions in Q3 2014, two of which were disclosed amounting to $81 million. The top disclosed M&A transaction this quarter was the acquisition of Polish Energy Partners, a wind project developer, by CEE Equity Partners, a Chinese private-equity fund, for $78 million.

Announced project acquisition activity in the third quarter was its highest since 2010, coming in at $5.3 billion in 49 transactions (19 disclosed) compared to $1.4 billion in 31 transactions (11 disclosed) in Q2 2014.

The Top 5 project acquisitions by disclosed amount were led by Laidlaw Capital Group, an investment firm, which signed a deal with Bard Group, a manufacturer, installer and operator of offshore wind turbines, to acquire the 400 MW Veja Mate offshore wind project in the North Sea for $1.3 billion. That was followed by wind project developer Masdar Abu Dhabi Future Energy, which agreed to acquire 35 percent of Norwegian oil and gas company Statoil’s stake in the 402 MW Dudgeon offshore wind project in England for $858 million. A consortium of Danish pension funds, PKA, Industriens Pension, Laerernes Pension and Laegernes Pensionskasse, acquired 50 percent of the 252 MW German offshore wind project, Gode Wind 2, from DONG Energy, an offshore wind project developer, for $812.7 million. Mainstream Renewable Power, a renewable energy project developer, acquired the 225 MW Ayitepa wind project in Ghana from NEK Umwelttechnik, a Swiss wind project developer, for $525 million. Rounding out the Top 5 was the $406 million acquisition of two Polish wind projects, Wroblew and Project 2 totaling 250 MW, by China-CEE Fund and Enlight Renewable Energy, a renewable energy project developer based in Israel, from GEO Renewables, a wind project developer.

investment firm, which signed a deal with Bard Group, a manufacturer, installer and operator of offshore wind turbines, to acquire the 400 MW Veja Mate offshore wind project in the North Sea for $1.3 billion. That was followed by wind project developer Masdar Abu Dhabi Future Energy, which agreed to acquire 35 percent of Norwegian oil and gas company Statoil’s stake in the 402 MW Dudgeon offshore wind project in England for $858 million. A consortium of Danish pension funds, PKA, Industriens Pension, Laerernes Pension and Laegernes Pensionskasse, acquired 50 percent of the 252 MW German offshore wind project, Gode Wind 2, from DONG Energy, an offshore wind project developer, for $812.7 million. Mainstream Renewable Power, a renewable energy project developer, acquired the 225 MW Ayitepa wind project in Ghana from NEK Umwelttechnik, a Swiss wind project developer, for $525 million. Rounding out the Top 5 was the $406 million acquisition of two Polish wind projects, Wroblew and Project 2 totaling 250 MW, by China-CEE Fund and Enlight Renewable Energy, a renewable energy project developer based in Israel, from GEO Renewables, a wind project developer.

Of the disclosed project acquisitions in Q3 2014, there were 20 investment firms, 14 project developers, seven utilities, and five independent power producers that acquired wind projects.

There were two Initial Public Offerings in the third quarter, CECEP Wind-power raised $63 million on the Shanghai Stock Exchange and ELTECH ANEMOS, a Greece-based wind project developer, raised $48 million on the Athens Stock Exchange.

There are 172 companies and 42 investors covered in this report. The report also includes 45 charts and tables.

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and research and consulting firm focused on cleantech. Mercom delivers market intelligence and funding and M&A reports covering Wind, Smart Grid and Solar and advises companies on new market entry, custom market intelligence and strategic decision-making. Mercom’s communications division helps companies and financial institutions build powerful relationships with media, analysts, local communities, and strategic partners. About Mercom: http://www.mercomcapital.com. Mercom’s clean energy reports: http://store.mercom.mercomcapital.com/page/.

Notable India Transactions this quarter:

VC Funding:

- ReNew Power Ventures received an $140M (~Rs.835 crore) in additional equity investment from Goldman Sachs, Asian Development Bank, and GEF SACEF India, a fund managed by alternative asset investment firm Global Environment Fund.

Debt Funding:

- GreenKo Group raised $550M (~Rs.3,300 crore) in a five-year overseas bond sale at a coupon rate of eight percent at maturity. The money was raised by its international arm Greenko Dutch BV and is guaranteed by the parent.

Project Funding:

- Atria Power received an equity investment for three wind projects with the total capacity of 126 MW from GE Energy Financial Services, a GE’s energy investing business for an undisclosed amount.

Project M&A:

- Ghatge Patil Group acquired wind power project of Bharati Shipyard, a ship building company, for Rs.55 crores (~$9M).