KOLKATA – January 27, 2015 – Mercom Capital Group, llc, a global clean energy communications and consulting firm, released its report on funding and merger and acquisition (M&A) activity for the wind sector for 2014.

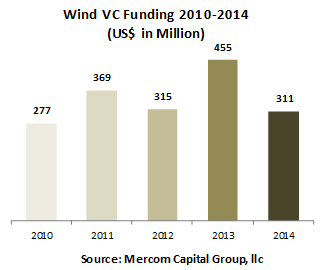

Global venture capital (VC) funding in the wind sector decreased to $311 million in 2014 compared to $455 million in 2013. Total funding into the wind sector reached $31.7 billion in 2014 including VC funding, public market financings, debt financings, and announced project funding deals.

The top VC funded company in 2014 was ReNew Power Ventures, a wind and solar power producer, which received $140 million. This was followed by BluEarth Renewables, a private independent renewable power producer, which received equity financing of approximately $71 million, STX France, a provider of offshore construction to renewable marine energy and oil and gas markets, which raised $27 million and Nenuphar, a France-based developer of a vertical-axis floating wind turbine, which raised $20.8 million. Rounding out the Top 5 was the $16.7 million raise by 3sun Group, a company that installs and maintains offshore wind turbines.

Public market financings accounted for $3.7 billion in 16 deals in 2014 including three IPOs (one yieldco) totaling $578 million.

Announced debt financing amounted to $7.7 billion in 23 deals in 2014, more than double the $3.8 billion in 10 deals in 2013.

Announced large-scale project funding in 2014 amounted to $20 billion in 120 deals compared to $18 billion in 114 deals in 2013. There were a total of 139 investors that participated in project funding in 2014. The most active project funding investors were KfW IPEX-Bank with nine deals, followed by Brazilian Development Bank (BNDES) with eight deals, and Banco Santander, Bayerische Landesbank New York Branch (BayernLB), and Eksport Kredit Fonden (EKF) with seven deals each.

It was a strong year for M&A activity in the wind sector in 2014 with 28 transactions, 12 of which were disclosed for a combined $4.6 billion.

“There has been a significant jump in the number of Yieldcos entering the renewable energy space, and for Yieldcos to grow they must continually add new projects to their portfolio. We will see a lot more Yieldcos jumping into the Wind sector in the near future and start actively acquiring quality wind projects worldwide,” commented Raj Prabhu, CEO and Co-Founder of Mercom Capital Group.

Of the 28 M&A transactions in 2014, Wind Downstream companies accounted for 20 of them, followed by Service Providers (four) and Wind Component companies (two). Manufacturers and BOS companies accounted for one transaction each.

The top disclosed M&A transaction in 2014 was the $2.4 billion acquisition of First Wind, a developer of wind projects, by SunEdison, and its yieldco company TerraForm Power. This was followed by the $567 million acquisition of a 33.33 percent stake in ACCIONA Energia International (AEI), the renewable energy generation business of ACCIONA Energia, by Kohlberg Kravis Roberts (KKR), Meanwhile, Brazilian utility CPFL, through its subsidiary CPFL Renovaveis, acquired Dobreve Energia, a renewable project developer, for $418.5 million. Boralex, a power producer, acquired Enel Green Power France (EGPF) for $371.9 million. Rounding out the Top 5 was the $252 million acquisition of Electrawinds, by Nethys (formerly Tecteo Energy), a clean energy developer.

There were 154 large-scale project acquisitions compared to 116 in 2013. A total of 24.6 GW in large-scale wind projects changed hands in 2014. Offshore wind project acquisition activity was on par with onshore project activity for the first time.

Of the Top 5 disclosed project acquisitions by dollar amount, the largest was the $1.3 billion acquisition of the 400 MW Veja Mate offshore wind project in the North Sea by Laidlaw Capital Group from Bard Group, followed by the $1.1 billion acquisition of a 25 percent share in the 630 MW offshore London Array 1 wind project by Caisse de depot et placement du Quebec (La Caisse) from DONG Energy. Brookfield Renewable Energy Partners acquired the wind portfolio – comprising 321 MW of operating wind capacity across 17 wind projects in eight counties in Ireland and Northern Ireland – of Bord Gais Energy (BGE) for approximately $960 million. NRG Yield acquired the 947 MW of operating wind capacity and a portfolio of land leases associated with the Alta Wind project located in Tehachapi, California, from Terra-Gen Power for $870 million. Rounding out the Top 5 was the $858 million acquisition of Statoil’s stake in the 402 MW Dudgeon offshore wind project off the Norfolk coast in Eastern England by Masdar Abu Dhabi Future Energy.

Mercom also tracked 41.8 GW of large-scale onshore and offshore projects in various stages of development in 2014.

There are 189 companies, 123 project announcements and 43 investors covered in this report. The report also includes 70 charts and tables.

To learn more about the report, visit: http://store.mercom.mercomcapital.com/product/2014-annual-and-q4-wind-funding-report/

About Mercom Capital Group

Mercom Capital Group, llc, is a global communications and research and consulting firm focused on cleantech. Mercom delivers market intelligence and funding and M&A reports covering Wind, Smart Grid and Solar and advises companies on new market entry, custom market intelligence and strategic decision-making. Mercom’s communications division helps companies and financial institutions build powerful relationships with media, analysts, local communities, and strategic partners. About Mercom: http://www.mercomcapital.com.

Project Funding:

- Welspun Renewables Energy, a renewable energy project developer, received financing for its 126 MW wind project in Pratapgarh district of Rajasthan. Debt component of ₹630 crore (~$102M) has been secured through long-term funding from a consortium of leading financial institutions. The power generated will be sold to Rajasthan’s electricity distribution company for a price of ₹5.93 (~$0.096) a kWh.

Debt Funding:

- GreenKo Group, an owner and operator of clean energy projects, including wind projects, received ₹767 crore ($125M) in investment from Washington-based energy and infrastructure-focused asset management firm EIG Global Energy Partners.

- Mytrah Energy, an independent power producer, raised ₹430 crore ($70M) debt from Merrill Lynch International, a Bank of America Merrill Lynch entity (BAML) and funds managed by affiliates of Apollo Global Management.