Global steel demand continues its broad recovery

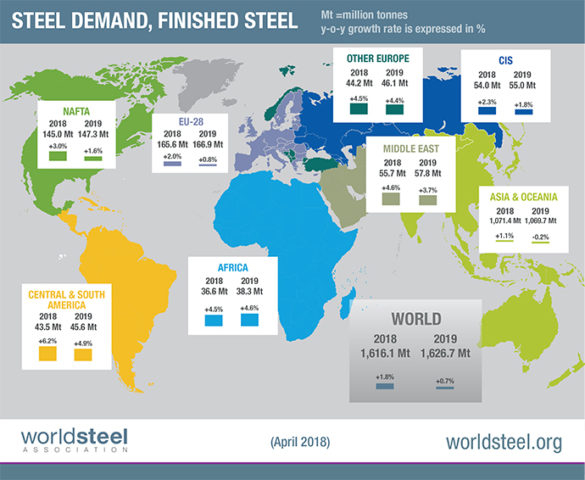

The World Steel Association (worldsteel) today released its April 2018 Short Range Outlook (SRO). worldsteel forecasts global steel demand will reach 1,616.1 Mt in 2018, an increase of 1.8% over 2017. In 2019, it is forecast that global steel demand will grow by 0.7% to reach 1,626.7 Mt.

Commenting on the outlook, Mr T.V. Narendran, Chairman of the worldsteel Economics Committee said, “In the next couple of years the global economic situation is expected to remain favourable with high confidence and strengthening recovery of investment levels in advanced economies. Benefitting from this, steel demand in both developed and developing economies is expected to show sustained growth momentum with risks relatively limited. However, possible adverse impact from rising trade tensions and the probable US and EU interest rate movements could erode this current momentum.”

Steel demand benefitting from favourable global economic momentum, but facing risks from rising global trade tensions

Upside and downside risks to this forecast are mostly balanced. In 2018, high confidence, strong investment levels and a recovery in commodity prices are generating a virtuous cycle for steel demand globally both in developed and developing economies. The slight deceleration in 2019 will be due to further deceleration in China and weakened investment momentum due to higher interest rates.

On the downside, possible escalation of trade tensions, rising inflationary pressure and tightening of US and EU monetary policies may cause financial market volatilities and trouble highly indebted emerging economies.

China will return to deceleration trend

In 2017, the mild government stimulus measures provided some boost to construction activity, but investment continued to decelerate and steel demand showed only a moderate increase despite the stimulus.

In 2018 and 2019 GDP growth is expected to decelerate mildly, but as the government continues to focus on shifting the growth driver toward consumption, investment is likely to further decelerate. Steel demand in 2018 is expected to stay flat. In 2019, it is expected to contract by 2.0% with a further slowdown in construction activity. In manufacturing, the machinery sector is expected to maintain positive growth on the back of a strong global economy while automotive and home appliances are expected to decelerate.

High corporate and local government debt continues to raise concern but a hard landing for the Chinese economy is unlikely in the short run.

Developed economies’ outlook remains robust

Steel demand in the developed world is expected to increase by 1.8% in 2018 and decelerate to 1.1% in 2019.

The outlook for steel demand in the US remains robust on the back of the strong economic fundamentals – strong consumption and investment due to high confidence, rising income and low interest rates. The manufacturing sector is being supported by a low dollar and increasing investment while rising housing prices and steady non-residential sector growth point to a healthy construction sector. Though the recent tax reform is further expected to boost steel demand through its positive impact on investment, there is some concern over a possible overheating of the economy. The announced infrastructure plan is unlikely to affect steel demand in the short term.

The EU economy has developed strong momentum with broadening recovery across countries. Prompted by robust domestic and external demand, investments are expected to remain a major growth driver while low inflation, wage and real income growth will support private consumption. Steel demand will be supported by a pickup in non-residential construction and strong manufacturing activities.

The automotive sector in both the EU and the US is expected to moderate due to saturation effect and rising interest rates, while the machinery sector is expected to benefit from rising investment.

An expected monetary tightening in the US and the EU is responsible for the forecasted deceleration of steel demand growth in 2019.

Steel demand in Japan has been benefitting from an improving investment sentiment and government stimulus, but the scope of growth will continue to be limited by structural factors such as an aging population.

Despite improved consumer sentiment, steel demand growth in South Korea will be constrained by high consumer debts, weakening construction and a depressed shipbuilding sector.

Developing economies ride the recovery momentum, yet to gain further strength

Steel demand in emerging and developing economies (excl. China) is expected to increase by 4.9% and 4.5% in 2018 and 2019 respectively.

Recovery in oil and commodity prices has improved the outlook for MENA countries. Provided geopolitical stability can be achieved, steel demand outlook for the region could further improve as a result of reconstruction activities

The mild recovery in Russia and Brazil is expected to continue. Recovery in Russia will be supported by credit expansion, easing monetary policy and improving consumer and business confidence. In early 2017 Brazil started to come out of its deep recession, but uncertainty remains as to the sustainability of this recovery momentum. Furthermore, recovery of construction activities has been slow. In other Latin American countries, recovery is also underway and growth in the region could accelerate if reforms are implemented, but the forthcoming elections lead to uncertainty.

Turkish steel demand showed strength in 2017, backed by supportive government measures. While slightly decelerating due to subsiding special economic stimulus, steel demand in Turkey is expected to show stable growth in 2018/19.

The Indian economy is stabilising from the impact of currency reform and GST implementation and steel demand is expected to accelerate gradually, mainly driven by public investment. Stronger growth is held back by still weak private investment.

Steel demand in ASEAN-5 countries dipped in 2017 due to slow construction activity and destocking. In 2018/19 however, steel demand is expected to regain the growth momentum backed by infrastructure investment.

- The World Steel Association (worldsteel) is one of the largest and most dynamic industry associations in the world. worldsteel members represent approximately 85% of the world’s steel production, including over 160 steel producers with 9 of the 10 largest steel companies, national and regional steel industry associations, and steel research institutes.

-

In April and October, worldsteel announces its Short Range Outlook (SRO), a forecast for steel demand (finished steel). The April SRO looks seven quarters ahead and the October SRO, which is announced at worldsteel’s General Assembly, looks five quarters ahead.