While some people see buying residential property as an investment, many people only buy that for residential purpose. However, in general, do people afford buying residential property in Asia nowadays? YouGov has recently conducted a survey to investigate people’s views on buying residential property across Asia Pacific.

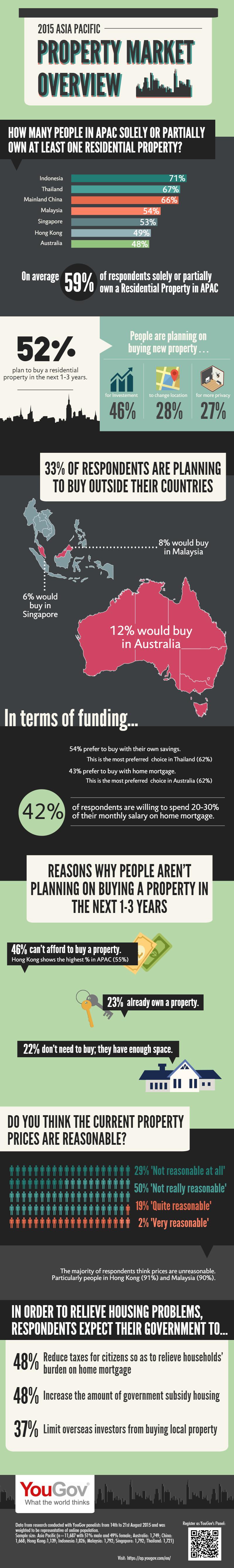

According to the survey, 59% of respondents currently own a residential property (solely or partially), of which the ratio of owning a residential property is the highest in Indonesia (71%), and the lowest in Australia (48%) and Hong Kong (49%).

In general, 52% of respondents plan to buy a residential property in 1-3 years’ time. Compared to those who do not own any residential property (48%), those who have previously solely (57%) or partially (52%) owned a residential property show higher tendencies to buy another property in the following 1-3 years. 33% of those who plan to buy residential property in the next 1-3 years are planning to buy outside of their country and Australia (12%), Malaysia (8%), and Singapore (6%) are the most preferred countries.

In regards to funding the purchase of a property, most of the respondents prefer buying ‘with their own savings’ (54%), and 43% consider ‘home mortgage’ as the best method. Across Asia Pacific, most Thai people prefer buying ‘with their own savings’ (62%), and most Australians prefer to use ‘home mortgage’ (62%), while only 14% of Thai people prefer ‘home mortgage’.

Among the 48% of respondents who are not planning on buying residential property in the next 1-3 years, most of them explain that they cannot afford to buy a residential property at the moment (46%), and 23% do not plan on buying because they already solely/partially own a residential property. The response ‘cannot afford buying a property at the moment’ is shown more in younger age group (60% in age group 18-24 years old) rather than in older age group (28% in age group 55+), whilst the response ‘already solely / partially own a residential property’ is shown more in older age group (35% in age group 55+) rather than in younger age group (6% in age group 18-24 years old). Compared to other countries, Hong Kong topped the list on the response of ‘cannot afford buying a property at the moment’ (55%).

Regarding the pricing of residential property, most of the respondents believe that it is not at all or not really reasonable/affordable (79%). These response was mostly shown in Hong Kong (91%), followed by those from Malaysia (90%) and least to be found in Indonesia (60%) and Thailand (67%). 42% of the respondents who are thinking of using ‘home mortgage’ set their ideal proportion of monthly salary allocated for home mortgage as 20-30%.

To relieve housing problems in their countries, 48% of the respondents expect their government to have tax reductions in order to relieve households’ burden on home mortgage. 48% of them also expect an increase in the amount of government subsidy housing.

This YouGov survey was conducted online among YouGov’s proprietary panelists between 14th and 21st of August 2015.A total of 11,687 people responded to the survey, of which 1,749 were Australians, 1,668 Chinese, 1,139 Hong Kongers, 1,826 Indonesians, 1,792 Malaysians, 1,792 Singaporeans and 1,721 people from Thailand. All data are weighted to be national representative of online population.